FUROSCIX's Label Update Is A Buying Signal For scPharmaceuticals

After a rocky first two years of launch, numerous tailwinds are aligning and setting the stage for a cash flow positive 2026 for scPharmaceuticals.

Word Count: 2,490 words, Reading Time: 12 minutes

scPharmaceuticals SCPH 0.00%↑ is a commercial-stage biopharma marketing the product FUROSCIX. FUROSCIX is a subcutaneous (“sc” hence the company name…) formulation of furosemide, a loop diuretic first approved in 1982. While the molecular entity may be old hat, the pharmacokinetics are actually pretty impressive. scPharmaceuticals is the first company who has been able to essentially replicate the pharmacokinetics and diuresis of two IV push injections of furosemide in one subcutaneous infusion that can be given at home with a drug-device combo.

Why is at-home administration important? The whole reason this product exists is because diuresis volume maxes out with oral dosing of furosemide due to mucosal edema reducing bioavailability and when you get to that point IV push injections of furosemide are the only option to get the necessary diuresis for symptom release. Or maybe I should say “were” the only option. Because IV push injections cannot be given at home and require hospitalization, hospitalizations due to congestion in Chronic Heart Failure patients end up incurring a lot of cost for the healthcare system.

FUROSCIX has the potential to change all that.

FUROSCIX as a product is not without downsides. It’s a bulky device, takes five hours to infuse, and patients can have a high co-pay depending on their insurance plan and if they have met their out-of-pocket deductible. But the downsides are worth it - it helps avoid an inpatient hospital admission. Payers and providers in theory should be jumping to use this and reduce admissions, length of stay if a patient is already admitted, and the rate of re-admissions. The sheer numbers of these admissions happening each year is how you arrive at some truly large addressable market numbers that you see below.

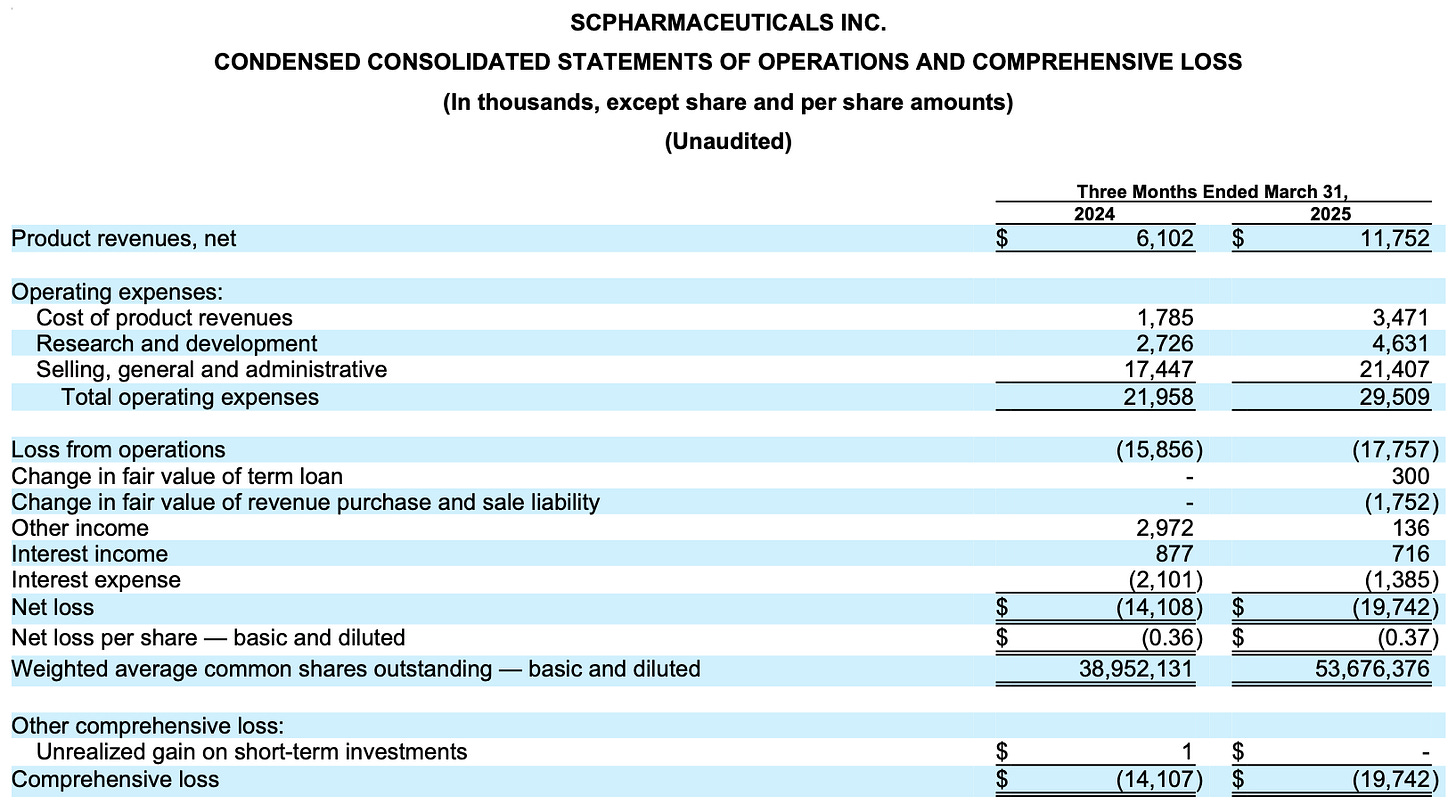

However, sales haven’t matched this potential. Not even close. In fact, the ramp has been awfully slow. The value proposition for this drug should be clear but something is not working when the drug net revenues are annualizing at only ~$46 million two years into launch when the addressable market is $9.9 billion for the heart failure indication alone. (There is another indication recently approved I will talk about shortly.)

As the company grows sales (slowly), expenses unfortunately are also growing and the net loss is widening. The company did a secondary offering last year to add cash to the balance sheet at the cost of adding ~15 million shares outstanding over the last 12 months but cash levels are now down to ~$57 million again with the cash burn from operations being ~$17 million last quarter. scPharmaceuticals (at their current burn rate) has cash until about the end of the year so it’s imperative that sales ramp QUICKLY to stem the quarterly net loss and begin to approach cash flow breakeven.

I expect the company to also do an offering after the next quarter’s conference call. (Hopefully after good numbers.) But that actually might cause a rally in the stock because extending the cash runway unquestionably increases the margin for error and takes the chances of a total wipeout off the table.

To sum it up, the company is playing a dangerous game and quickly needs to increase sales and their market capitalization to allow them to finance one last time to reach profitability.

So, with a novel product that solves a clear need in the marketplace in an extremely large market…why is the product not resonating?!?!?!?!

I have some ideas. Here is my list of potential problems.

List of potential problems:

Out of pocket costs for the drug can exceed out of pocket costs for hospitalization.

Device is bulky and takes five hours to infuse, has high cost of goods.

Cardiology practices are slow to adopt new technology.

Patient awareness of the product is low.

Lack of trust in the product.

To go one by one:

FUROSCIX’s average cost per HF episode is $4,737 and many Medicare patients have a $2,000 out-of-pocket max yearly. So especially early in the year the copay for FUROSCIX might be $2,000 whereas going to the hospital is a medical benefit that may be fully or partially covered. So while payers and hospitals may love FUROSCIX due to limited admissions or re-admissions, the system creates some perverse incentives for patients where an admission may be cheaper out-of-pocket to the patient than the medication to avoid it.

The current administration of FUROSCIX using the five hour, bulky infusion device is unquestionably not ideal but the company will be submitting soon for an autoinjector that not only has a lower cost of goods but is much more patient friendly reducing the administration time to 10 seconds and is also more travel-friendly. However, the company needs to get on strong financial footing to be able to realize the tailwinds that the autoinjector will provide.

So far cardiologists have not seemed receptive to scPharmaceuticals’ message. I don’t know if that is due to an undersized sales force, a poor sales force, the fact the initially the label was only for Class I-III heart failure (Class IV was added in a label expansion this past August - the product is now approved in all heart failure patients), or simply that cardiologists are unwilling to be early adopters to new technology.

The company with limited finances had no resources for direct-to-consumer advertising and the sales force was under-sized at launch to deal with the heavy lift of cardiologist and patient education here. Also the back-end support services also appeared to be undersized. The sales force and back-end support was recently increased.

A new product, even with the clinical trial data is great, requires some providers to experience it in the real world for 1 to 2 patients before they consider it as an option for all their patients. It takes time for trust in this product to work its way to all targeted cardiologists and the launch was also stunted by that initial label restriction where it could not be used in Class IV patients, the sickest severity patients. Some cardiologists thought if I can’t use this for my sickest patients, why use it all?

I understand I have painted a rather bleak picture above.

However, I do think there is reason to believe that all five of these points can improve by the end of next year. I also think the company is on a glide path to cash flow breakeven by the end of the year based on recent commentary on their earnings call. (See commentary below.)

But the most important part, and the reason I’m writing about this company now finally in its own article, is the recent label expansion to a second approved indication, Chronic Kidney Disease, in April 2025. This label expansion will most likely save the company and give them the time to unlock the blockbuster potential of FUROSCIX across all indications. Let me explain…

Why This Time Is Different

The label expansion into CKD not only enlarges the addressable market opportunity but allows the company to call on nephrologists, who manage both Chronic Kidney Disease and heart failure patients and are seemingly more receptive to FUROSCIX’s value proposition. Frankly, it may have been a miscalculation by the company to not include them in the initial launch just for the heart failure indication alone. But what’s done is done - the expanded sales force is now calling on them and based on hints dropped from management (in public transcripts!) they are writing for the drug.

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.