I Have Some Thoughts!

It's time to provide updates on each name in my biotech coverage universe and some new ideas.

Word Count: 3,977 words, Reading Time: 19 minutes

Note: Substack is telling me this post is too long for email. Subscribers, please view in browser if your email is cut off at the bottom.

Hi everyone, today I want to try a new feature called “I Have Some Thoughts!”

There has been a lot of news breaking across the biotech universe so I thought it would be prudent to provide updates on all the names in my coverage universe, plus some new names that caught my eye.

Companies covered: CRDF 0.00%↑ , FBRX 0.00%↑ , CDTX 0.00%↑ , EOLS 0.00%↑ , XERS 0.00%↑ , SCPH 0.00%↑ , HROW 0.00%↑ , AVDL 0.00%↑ , GERN 0.00%↑ , TARS 0.00%↑ , APLS 0.00%↑ , REPL 0.00%↑ , TGTX 0.00%↑ , CRNX 0.00%↑ , VYNE 0.00%↑ , EWTX 0.00%↑ , VIR 0.00%↑ , ARQT 0.00%↑ , CELC 0.00%↑ , CGEM 0.00%↑ , VRNA 0.00%↑ , DCTH 0.00%↑ .

Let’s get right to it:

CRDF 0.00%↑ - Cardiff announced on June 17 they were appointing a new Chief Medical Officer, Dr. Roger Sidhu, ahead of their next data update. They also announced they were delaying the timing of the next data update from June to July 29. The stock reacted harshly, with a -18.3% drop in the following trading session. I understand why investors initially reacted as they did. Cardiff previous CMO (now transitioning to an advisory role) was only with the company a little over two years and Dr. Sidhu has had relatively short stints at his recent past employers as well. Furthermore, it was posted on Twitter that he had a DUI conviction and reprimand by the California Medical Board. Additionally, whenever a company delays data investors get skittish that they are searching for a way to spin lackluster results. All of that was probably reflected in the intense drop the following session.

I could make a contrarian argument, however. First it’s important to remember Cardiff looked dead in the water over 2 years ago with a stock price around $1.75. The stock sits now at $3.51 with a $253 million market cap valuation. While that’s not a princely sum, it’s still a workable valuation from which to raise money without being extraordinarily dilutive and the company is overall in a more attractive place to attract talent. Furthermore, the company has near-term potential to enter a pivotal program within the next 12 months if the next data update is promising. An executive with regulatory and operational experience designing Phase 3 trials is extremely valuable, especially in mCRC. From the press release:

Previously, Dr. Sidhu spent nearly 10 years at Amgen in roles of increasing responsibility in the Hematology/Oncology therapeutic area where he advanced multiple therapeutic candidates. In mCRC, he led multiple phase 3 clinical trials of panitumumab (Vectibix®) in monotherapy and in combination with chemotherapy leading to approvals in the U.S. and globally. Dr. Sidhu was also a leader in advancing the science of RAS biology and therapeutics in mCRC and has published work in several peer reviewed journals including the New England Journal of Medicine.

Furthermore, the company has said that the data delay was due to processing delays for the reading of scans for Blinded Independent Central Review. I’m not sure how I could independently verify if that’s true but I tend to take them at their word on that as I always thought the turnaround timeline would be tight to have all 90 patients with multiple scans by June given when they announced full enrollment.

I still have mixed feelings before this data update. Twitter use “houndcl” posted an interesting thread where they believe the drug does not achieve the minimum concentrations necessary to provide efficacy, even synergistically. Their belief is the drug achieves the necessary plasma concentration only briefly, if at all, every 15 days and that patients who metabolize the drug slower tend to have severe Adverse Events, suggesting a narrow therapeutic window. Pharmacokinetic studies are not my specialty but this user showed their work and I haven’t seen it refuted yet. However, as they state in their thread neutropenia is an on-target toxicity and most patients seem to experience some grade of it making me wonder if maybe there is some variable missed and maybe patients are getting a higher exposure than calculated.

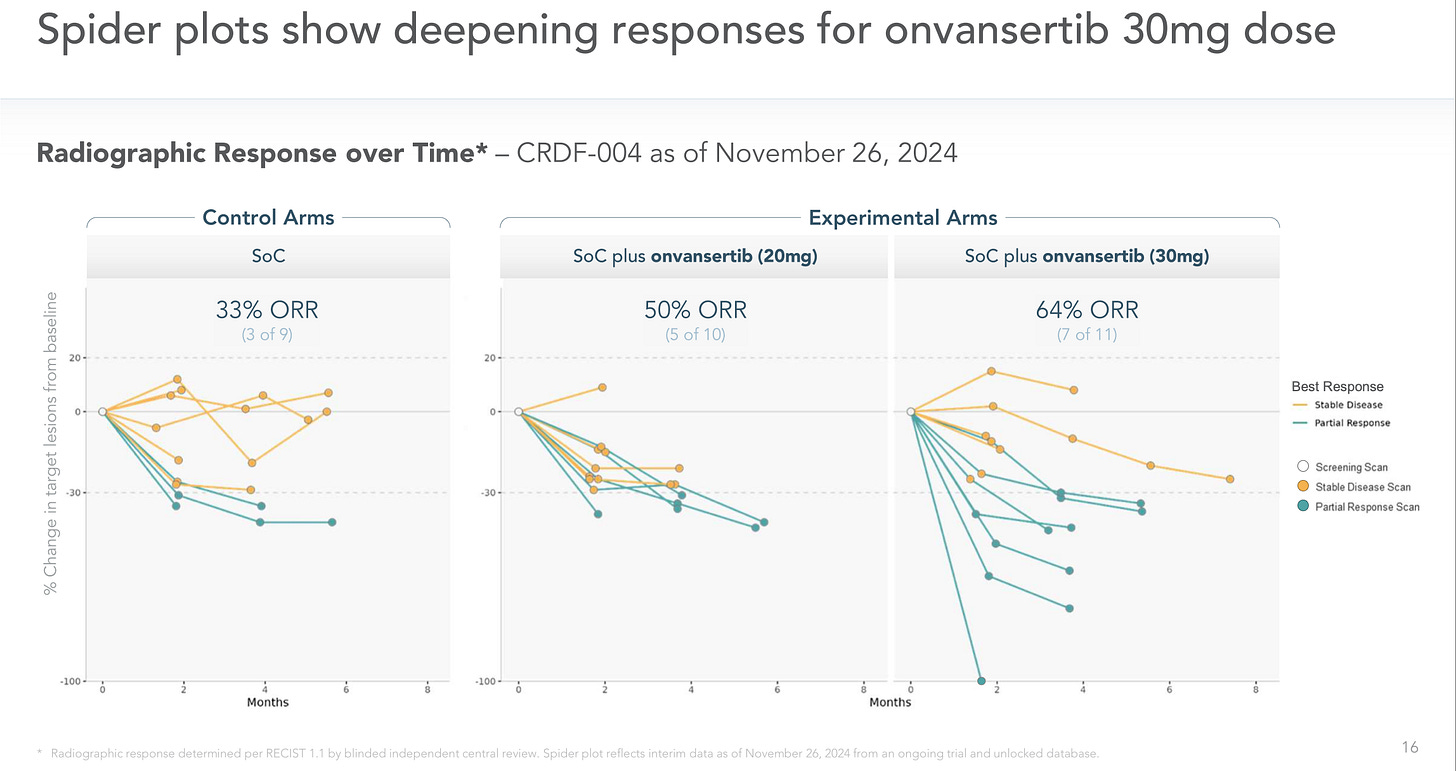

What also confounds me is that there are multiple signals showing synergy here. In the 1L RAS-mutated mCRC trial the five deepest responses at Month 4 are all in the SoC+30mg arm in a trial with 30 patients total.

Add on top of that, in the 2L mCRC trial patients that were “bev-naive” did significantly better than expected and the striking pre-clinical results showing reduced tumor size and far less vascularization in rats, in line with the hypothesis of reducing the tumor’s ability to adapt to hypoxia.

Short sellers are pressing their positions because they have a defined catalyst date for options (July 29) and a likely -70% drop if the data is ugly. But if they are wrong the stock will rally in a huge way. Get your popcorn ready. No position currently.

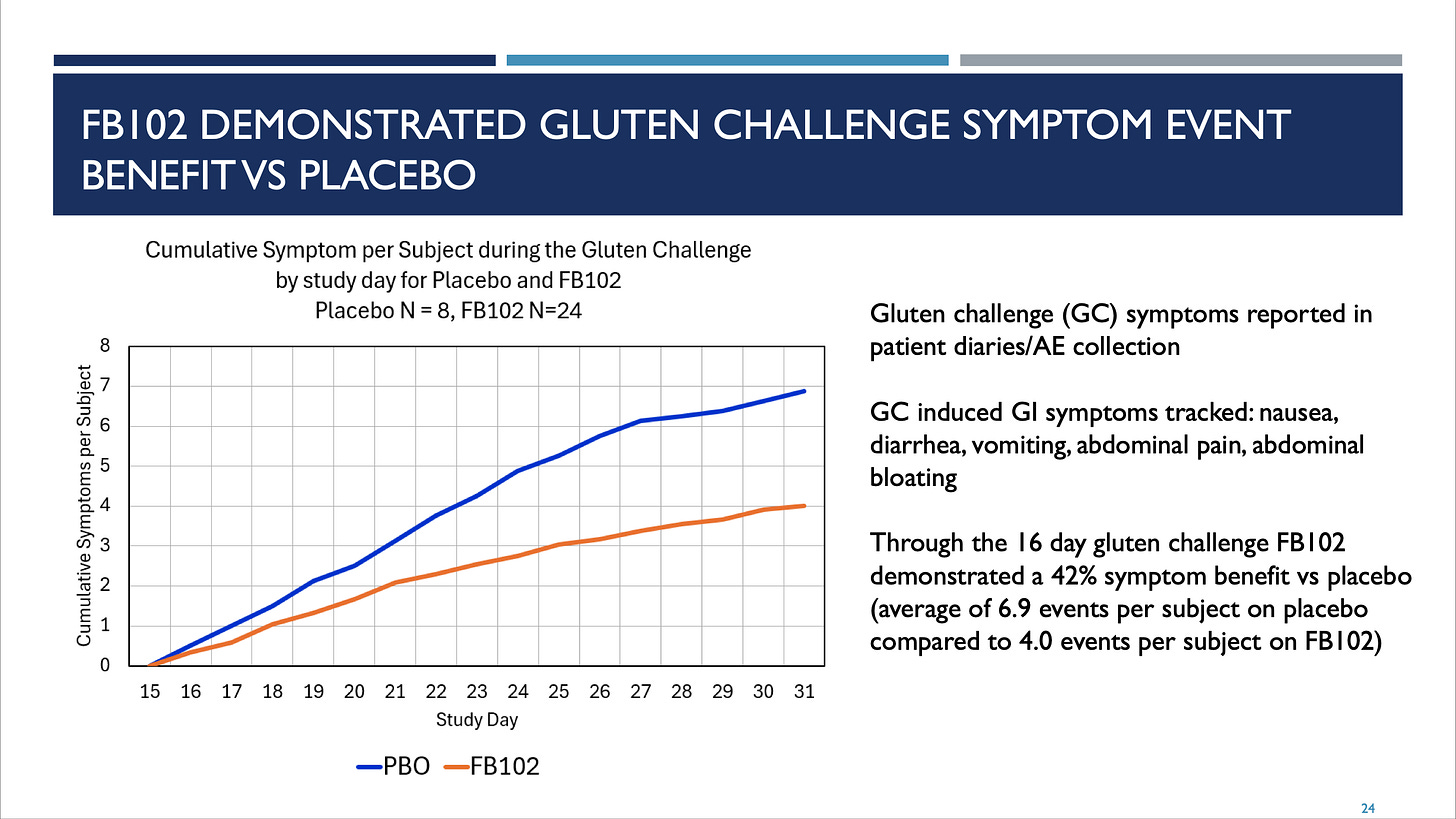

FBRX 0.00%↑ - Forte Biosciences reported some really intriguing data in Celiac Disease two weeks ago. I say intriguing both as a biotech investor and Celiac Disease patient. In a Phase 1b placebo-controlled gluten-challenge study, they were able to show a blunting of symptoms (42% reduction) but more importantly almost no damage on a metric related to mucosal health while the placebo arm showed marked deterioration.

Certainly symptom reduction is important from a quality of life perspective for Celiac patients as they often live in fear of being “glutened” - receiving accidental exposure to gluten despite their best efforts to avoid which can cause bloating, diarrhea, fatigue, and other symptoms. From personal experience I can say it is an exhausting affair - when as little as 1/200th of a piece of bread can trigger symptoms you have to be quite trusting of the food you eat when outside of the house and when traveling. But even symptoms can be murky - occasionally I know I’ve accidently been exposed to gluten and not always do I have a dramatic feeling of illness. In fact, my initial diagnosis took years because the amount of episodes in a given month intensified slowly but sporadically and not always in direct correlation to the diet I was eating. And I have a laboratory and endoscopy confirmed case so I am personally confident that symptoms are not the most reliable measure.

Thus, perhaps even more important to me are mucosal health measures which are more concrete and correlated with the outcome that is most serious which is decreasing the risk of malignancy. In this (very small, very short) study the product candidate FB102 showed near curative effects on mucosal health despite gluten challenges with 8 grams of gluten per day. That’s roughly equivalent to eating four pieces of “normal” bread. (Canyon Bakehouse is a delicious gluten-free bread, btw. Enjoyable even for gluten eaters.)

Forte Biosciences was plagued by a nanocap valuation after their high-profile failure in atopic dermatitis but FB102 is a completely new product candidate completely unrelated to any past trial failures. And on the strength of these results, they were able to raise $75 million dollars to essentially recapitalize the company and get them to a proper Phase 2 readout in 2026 which could give investors real confidence there is a signal here.

Celiac Disease is a hard disease to develop in, partly for the sporadic symptom reasons mentioned above and also because avoiding gluten is an extremely effective treatment even if it is very difficult for a patient’s quality of life. Of the Big Pharmas, only Takeda seems to be even trying to develop drugs here despite over 1% of the population being affected. And to my knowledge only one drug candidate, larazotide, has even progressed to a Phase 3 trial where it failed on an interim analysis. So the history here isn’t great. Thus, I’m encouraged by this data as a patient and as an investor if the Phase 2 data, guided as of now for 2026, shows a real signal then I think it could actually be a good investment too depending on safety and tolerability, frequency of administration, and drug pricing. I personally would still stick to a gluten-free diet but it would be nice to be a lot less stressed about accidental exposure and I’d be happy to pay a co-pay and take a drug that allows that as long as it was safe and the cost was reasonable. I think the company is a buy on any further good data.

CDTX 0.00%↑ - Here is another pleasant surprise. I thought Cidara as a company was dead into the water until their June 23, 2025 press release. Their non-vaccine candidate for influenza prevention had reported some mixed data back on March 1, 2023 which slightly confounded by a lower than expected placebo infection rate, reducing prevention efficacy below company expectations. The drug candidate was then partnered with well-respected Johnson & Johnson but on April 26, 2024 Cidara reacquired full rights. At the time I thought that was a red flag because, although Big Pharmas can have make mistakes with pipeline prioritization, J&J got a really good look “under the hood” at this program and sold it right back where they got it.

While Cidara’s Phase 1b results showed a 57.1% prevention efficacy, their much larger Phase 2b dataset released 14 days ago showed 57.7%, 61.3%, and 76.1% prevention efficacy in a dose-dependent manner. This is excellent efficacy in a modality that is both non-vaccine and appearing to be safe and tolerable so far. While this candidate is not intended to replaces vaccines, rather be used on top of them, it has to be stated that the current regulators appear to be staunchly anti-vaccine and thematically this appears to be a tailwind for Cidara.

Others have pointed out concerns about cost of goods sold, drug pricing, and where exactly this fits into the guidelines (aside from just “high risk” patients) but excellent dose-dependent efficacy is not what I expected here. I didn’t think Cidara had the juice. They clearly do and this is a massive win for their platform. Currently at a $1 billion+ valuation so it’s not a screaming buy but it’s back on the watchlist for a future pullback and for further due diligence. They also have $500 million cash so the margin of safety is pretty decent on any pullback, as well.

EOLS 0.00%↑ - Evolus stock has been extremely weak since announcing that their Chief Financial Officer took a CFO job at a private company. Furthermore, since the move was lateral and going from public to private, investors are assuming this portends to weak future financial results from the company. I’m not convinced.

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.