Hi everybody,

No time to waste. Here’s what I’m watching in 2025 for biotech investing (using stock symbols, not company names, for clarity and quickness):

Psst…subscribe or follow through the app as next week I’m releasing my 2025 model portfolio which will be a completely free post. Don’t want anyone to miss it. ☺️

Also Substack is once again telling me this post is too long for email (6,092 words and some pictures?!) so if you don’t see my signature at the end then you aren’t seeing the full post.

Nine Themes For 2025

Cardiac Gene Therapy:

If you had to pick a sub-sector of biotech investing that is the most hated right now it is quite possibly Gene Therapy for cardiovascular indications. The main catalyst will be RCKT ($13.51 at time of this writing, 52 week range of 12.63-32.45) and their pivotal data in Danon Disease. People I think generally agree the trial will “work” as far as hitting its endpoints so the real concern is in patient identification and how motivated patients and providers will be to use a $2 million+ therapy out the gate. Of course, payers will be pressured to cover it (especially in light of recent backlash towards health insurers) but uptake in the first year may be slower due to the administrative issues, activating treatment sites, and possibly lower risk patients wanting to see real world safety data. There are Danon patients identified but being the first-in-class therapy is always a heavy lift as far as establishing the market - but with the benefit of no competition of course. Possibly even more hated still is LXEO ($8.36 at time of writing, 52 week range 5.77-22.33) with a lead program in Cardiomyopathy associated with Friedreich Ataxia. It’s pretty clear the stock is “cheap” if based upon the addressable market and modeling a decent chance of success in Phase 3 but there is quite literally no guided event in 2025 as of now that provides the “FOMO” to get buyers off sidelines. 2025 will have regulatory alignment in F.A., plus updates in PKP2-ACM (a program that will have competition from RCKT), maybe an update in Alzheimer’s APOE4 (a program that is quite literally a waste of money that management has so far refused to kill), and a pre-clinical program. Very cheap on an enterprise value basis currently but how much cash will they burn until they get to a catalyst investors actually care about? TNYA ($3.58 at time of writing, 52 week range 1.61-7.01) is in this space as well with AAV gene therapy programs targeted at MYBPC3+ Hypertrophic cardiomyopathy as well yet another program in PKP2+ Arrhythmogenic right ventricular cardiomyopathy. Really, I don’t see anyone talking about TNYA anymore but the chart isn’t quite as ugly as the other two. They guide to cash until 2H 2025 and are also guiding to releasing some data in their lead indication very late in 2024. Without the benefit of seeing that data and the reaction to it, and knowing they will be doing a rather large financing early in 2025, I can’t see it being a buy in 2025 because the goalposts will move to regulatory clarity and what will be required for a pivotal trial. Really all these companies have interesting science, an unmet need, and a relatively friendly regulator in the FDA currently. Yet, all three have no excitement behind them. These companies as a group need to be aggressively telling their story on why gene therapy will be commercially successful and maybe with some luck the tide can turn starting in late summer/early Fall with the run-up into RCKT’s data. Biotech goes in cycles - there was once euphoria around RCKT that sent it to the $60/sh level in 2021. Times sure seem dark now but it could be a different story by the end of 2025. I personally don’t see any current reason to own these names before summer 2025, though. It feels like a while before the tide turns but I do think over time - and the first successful pivotal trial - it will turn.

Cardiac Myopathies:

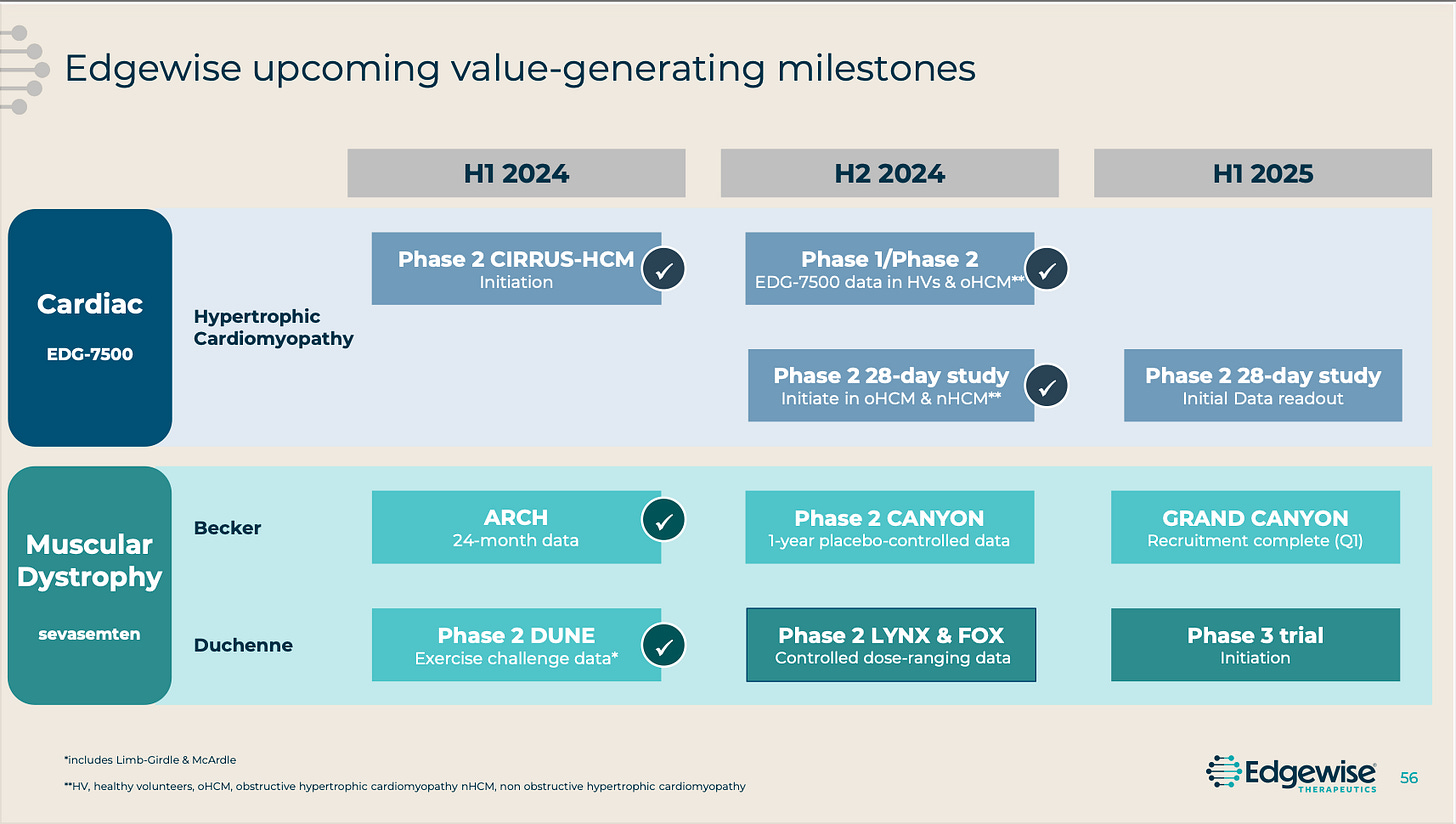

CYTK ($50.55 at time of writing, 52 week range 32.50-110.00) should be approved in 2025 to compete with CAMZYOS in obstructive Hypertrophic Cardiomyopathy. Their Phase 3 data beat expectations at the time but their management has not. Frankly, they seemingly missed their window to sell the company and are now going into commercialization despite a questionable track record of execution and focus. I have not owned the stock but the long-time holders seem rather miserable being saddled with this management team especially when the stock traded up to $110 within the last year. ($110 is now a distant memory and probably will be for years, if not ever.) A possible reason why the buyout may never materialize is the lurking data updates from EWTX ($29.46 at time of writing, 52 week range 6.44-38.12) which should have incremental updates on their oHCM agent which has a differentiated MoA leading to possible improved tolerability relative to the aforementioned two agents, no need for dose titration, and no need for periodic echocardiograms to monitor for heart failure. It’s extremely early still, and I have seen arguments wondering how much those improvements matter, but any possible best-in-class therapy in a $5b+ market should not be ignored. Plus, Edgewise management strikes me as much more self-aware and capable to strike a deal while their leverage is high. I suppose CYTK could still sell but by the time they are approved EWTX will have published more Phase 2 data and I can’t imagine buyout offers being increased much after the drug is approved. The market is pricing in very high odds that the drug will be approved on the PDUFA date.

CD19-targeted therapies for autoimmune disorders:

2025 will be a defining year for the thesis of targeting CD19 to treat autoimmune disorders. Emerging from NEJM articles in 2021 and 2024, using CD19-targeted CAR-T Cell Therapy to treat Systemic Lupus Erythematosus became a hot topic for investors who wanted to speculate which public companies could be used to play this trend. And public companies responded to this interest by launching what felt like a million programs. CAR-T Cell therapy, NK cells, T-cell engagers…I was already following CGEM ($12.55 at time of writing, 52 week range 7.68-30.19) for oncology when this all happened and to my eyes T-Cell engagers were by far the best modality considering efficacy, safety, and scalability. In fact, when they first announced a pivot of their T-cell engager from oncology to autoimmune disease I posted this:

On the day I posted that, the stock opened at 11.67 and closed at 12.41. Since then they have gotten a ton of attention, raised a ton of money, and this is unquestionably their LEAD asset. 11 months later, the stock is at…$12.55! Granted, a higher market cap with the higher share count and they flooded the market with supply but…this isn’t even early innings. The game has not started! The stock has quite literally not reacted to them possibly having the most advanced agent in the potential best modality to treat 15-20 autoimmune disorders. That seems significant!!!!!

To contexulize, here is the potential market just for CD19-directed I&I therapy in the two indications CGEM is tackling first: 193,000 SLE patients with moderate/severe disease and no disease-modifying standard of care. 163,000 Rheumatoid Arthritis patients who are multi-drug resistant to standard of care agents. And we get the first proof-of-concept company-sponsored data in Q4 2025.

There will be other movements in the space before that. CAR-T readouts like those from AUTL ($2.87 at time of writing, 52 week range 2.69-7.45) will come throughout the year but those have not been moving stock prices like in the initial gold rush stage. Investors are a bit more selective now, or possibly overwhelmed. Given the complexity and cost of CAR-T, I think there are real doubts about this could be a commercial viable therapy. NK cell therapies and Gamma Delta t cell therapy haven’t even gotten off the ground in oncology and probably should be viewed with extreme skepticism for now. The other way to play the CD19 T-cell engager trend for I&I is CLYM ($3.08 at time of writing, 52 week range 2.35-11.55) which trades at a discount to Cullinan, albeit with much lower cash levels. Personally, I find Climb Bio’s management team to be extremely unimpressive and they seem to be behind CGEM in time to data as well. I would rather focus more on the team I trust. And it’s not like CGEM is expensive - quite the opposite.

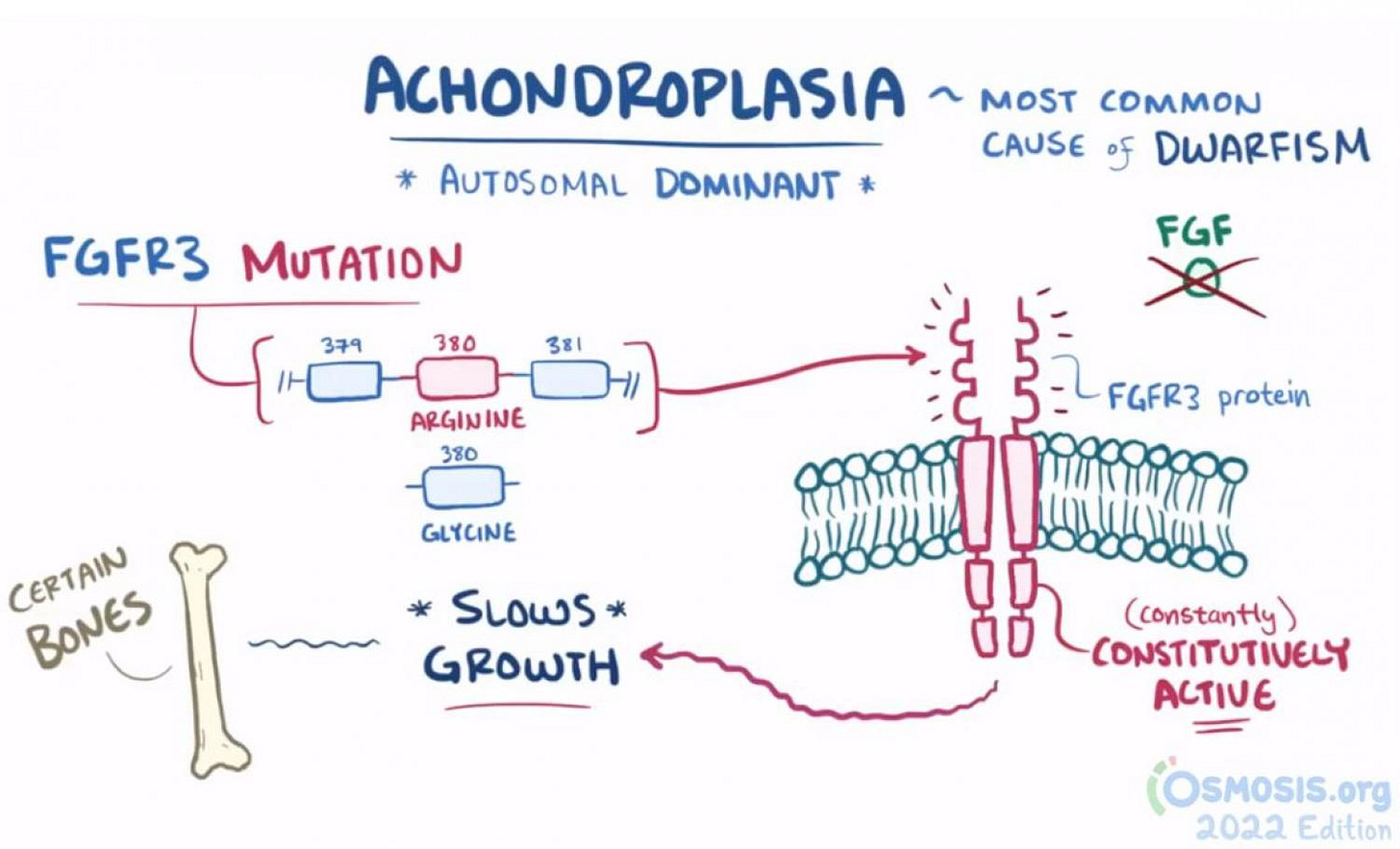

FGFR3 inhibition for Achondroplasia:

Achondroplasia has proven to be a very real market for BMRN ($66.43 at time of writing, 52 week range 61.15-99.25) which has an injectable drug with moderate efficacy annualizing at $800m per year. But I would not invest in them ever because that golden goose is on very short time, in my opinion. (Well, other reasons too.) BBIO ($29.04 at time of writing, 52 week range 21.68-44.32) has a much superior agent both in efficacy (patients get taller) and route of administration (oral). Furthermore, I think it’s an easy sell because it is truly treating growth dysplasias at the source by targeting FGFR3 which is the mutation responsible for decreased growth.

The safety is more than acceptable too. BridgeBio will have pivotal data by the end of 2025 and is a fine way to play this trend but your upside is diminished because they are a $5.5b market cap due to their ATTR cardiomyopathy drug. Their Phase 3 readout might not affect the stock price much because success is relatively priced in and everyone in the stock is hyperfocused on the ATTR launch. Where I think it could move a stock more and where success is less priced in is TYRA ($16.23 at time of writing, 52 week range 11.32-29.60) which believes it has a more selective agent that could perhaps be even more efficacious. The BridgeBio data looks pretty darn good and I think it would be hard to improve on it but if they make a real blockbuster market in achondroplasia and hypochondroplasia then there is value in having a “me too” agent even if they are 3-4 years behind. Those two indications combined are going to be a multi-billion market in five years, I think.

Geographic Atrophy:

Geographic Atrophy as an indication was at one point was pegged to be a mega-blockbuster field (like $3b+ peak sales for each of the two marketed agents) and a testament to the innovation of biotech companies. 1 million patients slowly losing their vision, $12,000 to $24,000 annual cost (based on dosing frequency), patients predicted to be on therapy for many years, no FDA approved agents, high unmet need (blindness!), affluent and insured patient population, specialists hungry for a new therapy that can drive revenue. But now…everyone is hedging and freaking out a bit and the first question to APLS ($34.64 at time of writing, 52 week range 24.34-73.80) at the Evercore conference was is this still on track to be a blockbuster? What? How did we get here…is it warranted?

APLS’ drug had fears out the gate due to uncertain safety (cases of retinal vasculitis were seen) but with the drug annualizing at $600 million it has gained good traction and the safety profile is fairly well established with so many doses given now. It’s not perfect but I think a 1:4000 chance is perfectly acceptable for a first generation agent in the space. But…there are just no second generation agents seemingly coming. The pipeline in Geographic Atrophy is very bare. Still, the goalposts are being moved for the approved agents. Now that revenue was flat QoQ for one quarter people are declaring the launch as peaking. Ignoring that vial growth was 7% QoQ, there was a lot of competition from competitor ALPMY (traded OTC in US, $10.33 at time of writing, 52 week range 9.15-13.14) in rebating, and the working assumption was there would be parity in the labels for the two agents. But now things have changed -ALPMY got a CRL for their label expansion for on-label every other month dosing and dosing beyond one year. APLS is claiming this changes everything and it will meaningfully affect providers prescribing habits and more importantly what payers will reimburse and possibly even introduce clawbacks for off-label dosing. Who’s right? Only time will tell but I do feel the ALPMY news is a big event in this market. And even if it wasn’t: APLS was still tracking for vial growth 30% YoY…we all know rebates and discounting wars eventually die down. We know the market is less than 10% penetrated. Even without this gift, I think they were going to be alright. But this is a gift to their sales force. And frankly their efficacy data does look better even if the AE rate is maybe just ever so slightly higher.

So two schools of thoughts. One school that says once a launch decelerates in revenue it can never pick up steam. And then APLS bull thought that last quarter was a one quarter hiccup driven by an aggressive move from the only challenger in t he space and now the calculus has changed due to the FDA’s regulation towards that challenger. Who’s right? We’ll see. It’s still very possible in my eyes that they both win and become multi-billion dollar products. But I don’t think the recent news has been given enough discussion. It’s fairly major but the stock is only up 10%.

Speaking of the pipeline being dry for next generation agents, I’m really sad what has happened to LCTX ($0.61 at time of writing, 52 week range 0.50-1.61)…they partnered their GA drug with Roche and just nothing has happened with it. I knew it would be hard to scale and develop a Phase 2 program for the modality it is in but it’s still a bummer because it seemed like the first agent that could actually reverse vision loss not just slow the loss. Maybe the biggest bear case about the first generation complement agents is they just slow decline and that’s not that exciting for patients. But if nothing else in the next five years can top that I still feel they will get fairly deep penetration in the market. The alternative is still vision loss and that’s still a terrifying thing to be facing.

HR+/HER2- Advanced Breast Cancer:

Two readouts that matter most in this space IMO: ARVN ($24.59 at time of writing, 52 week range 21.17-53.08) in Q1 and CELC ($12.73 at time of writing, 52 week range 11.51-22.19) in Q2. Both of these drugs are trying to improve the standard of care in this space but in different ways. ARVN is trying to replace fulvestrant with vepdegestrant, an estrogen receptor degrader, and CELC is trying to develop gedatolisib, a PI3K/mTOR inhibitor, used on top of fulvestrant (and possibly CDK4/6 inhibition) in both PIK3CA WT and MT cancers. The distinction in their Phase 3 is because there is an approved agent in PIK3CA MT cancers so the SoC (alpelisib + fulvestrant) is slightly different.

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.