Disclaimer: Not investment advice. Do your own research. For informational purposes only. I reserve the right to change positions after publishing as events change. Position rankings are accurate as of post-market 4/29/24 when writing was started.

Two new names enter the Top 10 this month, and two leave…one because of a very nice run-up and buyout! Let’s begin.

My Current Top 10 Biotech Positions, By $ Value

#1: Celcuity (CELC) [Last Month: #1, ↔️]

The company has had no material news I can see in the last month. They have been good about telling their story at a few investor conferences but aside from that really nothing to report here.

#2: Edgewise Therapeutics (EWTX) [Last Month: 2, ↔️]

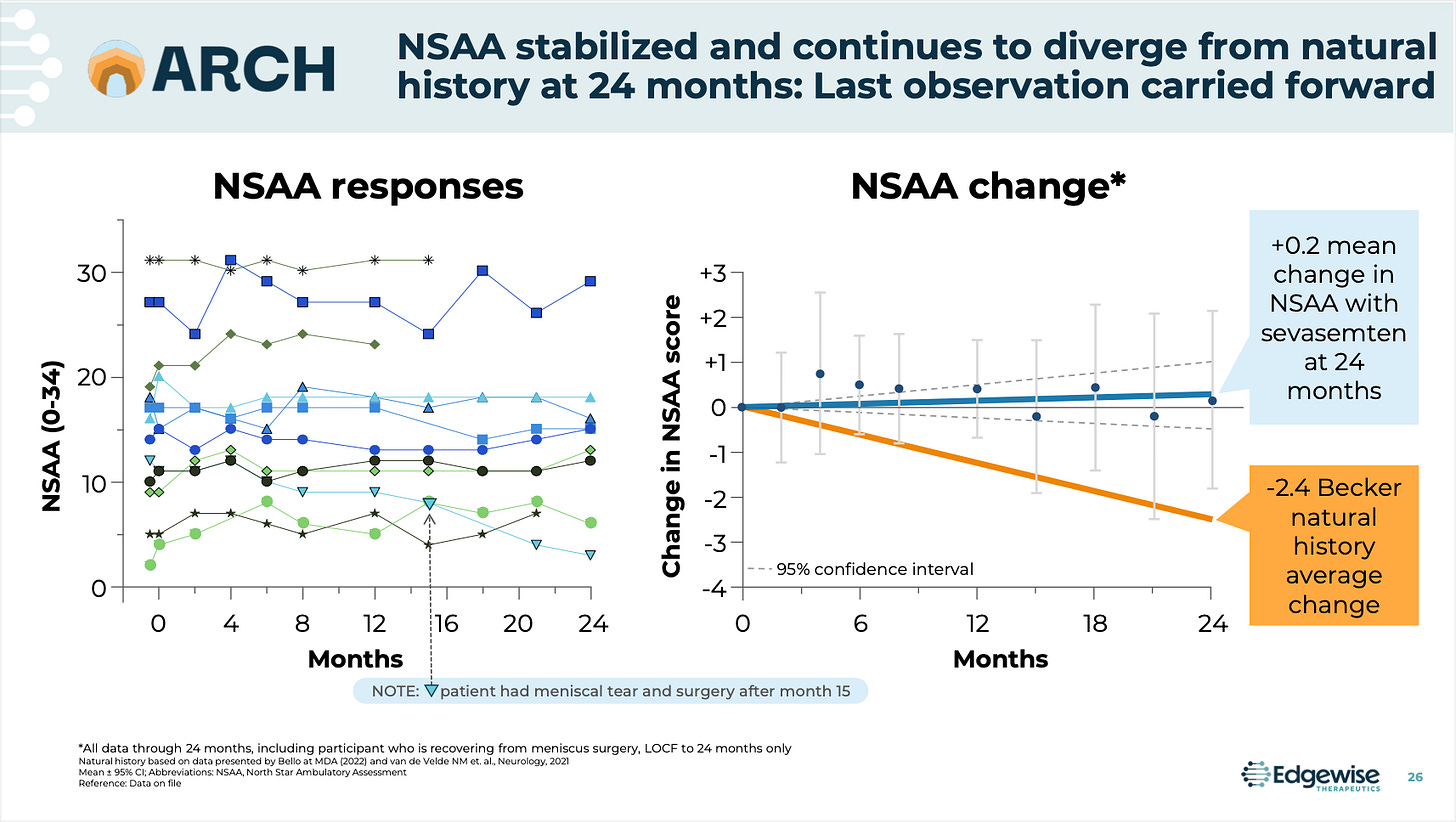

Edgewise reported what I felt was excellent 24 month OLE data in Becker Musclar Dystrophy but the market mostly shrugged it off. In fact, the stock went down more than the XBI in the week following so I would argue the market really doesn’t care about the BMD program or ascribe a high probability of success here. And I understand 12 patient data in an open label setting won’t light the world on fire but if you believe the natural history studies (I do) then stablizing a group of patients for out to 24 months seems noteworthy to me. The NSAA is a very rigid and validated metric and even with open label masking I think it would be hard for patients to “game” the trial by showing stablization or improvement if the drug is inert. But I could be wrong on that. Placebo controlled data in Q4!

I still view EWTX a lot like FULC: a very promising but risky program in the musclar dystrophy space with the possibility to stablize patients who have significant morbidity; with the caveat that the data so far is not placebo controlled like FULC’s is and the sample size is smaller. But with EWTX you get the upside of the uncorrelated HCM program which holds significant valuation and has data next quarter that the Street and biotech funds seems more focused on anyway. But it’s a variation on my theme of being invested in novel therapeutics in muscular dystrophy that could be first ever approvals in their respective indications.

#3: Insulet (PODD) [Last Month: NR, ⭐️]

I made the business case for Insulet in my first ever audio podcast that should be uploaded by the time this posts. See here!!!

Also, I recently did a thread on Twitter about my son’s experience starting the Omnipod 5. To save you from going to Twitter I’ll post all the content here in the quote block:

I have mentioned in the past my son’s T1D diagnosis…I have an exciting update! He started on the Omnipod 5 last week. It is *incredible*! Literally life-changing for our family. I truly feel what the iPhone was to smartphones the Omnipod 5 is to diabetes management.

And, yes, I think $PODD is a screaming long but saving that for newsletter. I want to limit this thread to my experience as a caregiver. First the results: my son’s time in range has increased by over *6 hours* per day. (Clinical trial results were 2.9 hours/day improvement.)

The crazy thing is I was working HARD at managing his diabetes before. (Diagnosed August ‘23.) Fought for a CGM right away because he is non-verbal. I go to his pre-school at lunch to give bolus injection. Perfectly counting carbs/controlling environment. FIVE injections/day.

Oh, btw, I’m a PharmD. Even with all that I still wasn’t getting the A1C for him I wanted. I saw a TV ad for Omnipod on Christmas Day while watching basketball. (Of course.) Tubeless, hmm. I tucked it away to ask about if Mason was a good candidate at next appointment.

I really like our Endo and asked what he thought. He said he likes Omnipod and Tandem T-Slim, a tubed pump. I wanted Omnipod. They had me do an online class with all the options. Omnipod seemed CLEARLY best. I have never been happier with a decision, despite the issues.

What issues? First, it only works with Dexcom G6 for now, not Dexcom G7 or Freestyle Libre 3 which we were using. I prefer Dexcom’s products now to Freestyle (that’s another thread) but changing sensors and getting new apps is a barrier. The G6 is also bigger than G7/FL3.

Second, they still don’t have an iOS app out. “Testing.” It’s ridiculous but you have to carry a provided locked-down Android controller. In addition to a dedicated iPhone needed to link w/ Dexcom that means I carry three phones when with my son. Not ideal! Yet, worth it!

Why? The Pod is amazing engineering. Smaller than you think, fits on 8 different sites, very durable, easy setup/fill process with fast-acting insulin. Great hardware. But it’s the software interaction between CGM and AID (automated insulin delivery) system that is the magic.

I love having the Pod replace five injections/day (basal, three meals, 10pm adjustment) but the Pod also has the freedom to adjust the basal rate. That’s the CGM integration and “AID” part. Going low, it stops basal. Going high, it cranks the basal up. Looks an hour ahead.

We’re on our third Pod now (change every 3 days) and the algorithm improves each time. He has BG spikes when entering deep sleep and the Pod learned and increases basal aggressively now. I can’t articulate how much I love not giving an injection while he sleeps.

In addition to time in range, we have had no hypoglycemia events so far, very limited time over 300mg/dL, no hardware issues, far better quality of life. It’s so nice to treat my son like a normal kid when it comes to food. It’s very close already to an artificial pancreas.

The future will be even better with iPhone integration, one less device to carry, Dexcom G7/FL3 support, software updates, etc. but it’s already great. There are 10 million+ people worldwide taking multiple injections for Diabetes (Type 1 and Type 2). This can help so many.

Tubing sets were the main reason I didn’t consider competitor pumps. With his sensory needs, removal before bathing/swimming, risk of tear/breakage it was a non-starter. Tubeless is game changing and first-in-class. Also, nice to pick up at pharmacy and not need DME benefit.

I’m so grateful to have this technology available to us as I’m certain it will lengthen Mason’s life. It also renews my fire to be a healthcare investor. The industry isn’t perfect but the breakthroughs are incredible progress. Thank you to everyone who worked on this.

FULL DISCLOSURE/PLEASE NOTE: I own Insulet ($PODD) stock. However, I owned zero shares and had no interest in the stock before using Omnipod 5. I’ll cover valuation/catalysts/competition in a newsletter post at end of April. (Spoiler alert: cheap/a lot/very little)

(Also, keep in mind this was formatted for Twitter and to be accessible to people who don’t know me as well as readers here might.)

#4: Fulcrum Therapeutics (FULC) [Last Month: 3, ⬇️]

Aside from one conference presentation, I didn’t see any notable news from the company this month.

#5: Cullinan Therapeutics (CGEM) [Last Month: 4, ⬇️]

There is a lot of news here! As I corrected predicted last month, Cullinan is all-in on the autoimmune space and has changed their name to Cullinan Therapeutics. They did a huge private placement at $19/share with notable biotech funds and the stock went up to $20+, then plummeted to $15, and is now up above $25. I have reduced exposure a bit because I do think the next catalysts are a bit off and couldn’t help myself with the company finally being recognized although I have to admit I kind of regret it and am wondering if this should be a Top 3 (or Top 1?) position right now. Oh well, I did what I thought was right in the moment.

Here are some notable tweets on the autoimmune CD19 space from the excellent “Professor Oak”:

https://x.com/Prof_Oak_/status/1782924188623450396

https://x.com/Prof_Oak_/status/1783843550645387435

#6: Elevation Oncology (ELEV) [Last Month: #6, ↔️]

No major news, the ADC space continue to be hot even if Elevation has pulled back some…I continue to expect excellent ORR with acceptable safety by mid-year. 13G forms show increasing and high quality institutional ownership. On competition in this space a good tweet (now deleted so I can’t link - sorry!) laid out why only AZN and Merck are relevant competition in Claudin18.2. Certainly serious players in oncology that are well-funded but this space isn’t as crowded as some may think.

#7: BridgeBio (BBIO) [Last Month: 8, ⬆️]

BridgeBio has a huge overhang right now with the impending “HELIOS-B” dataset upcoming from Alnylam Pharmaceuticals that will compete with Bridge’s main pipeline asset. Their secondary asset won’t have data until late 2025. I do want to point out their teritary asset is another novel potential first/best-in-class therapy for a muscular dystrophy, continuing the theme from above.

There is real debate among my followers about how much the rest of Bridge’s pipeline is worth minus their primary ATTR asset.

I say $15 or more which makes me very comfortable owning the stock ahead of HELIOS-B which I think will be an inferior dataset anyway. But many apparently disagree on both points and that’s why the stock trades around $25/share.

#8: Avadel (AVDL) [Last Month: 9, ⬆️]

Earnings coming up in two weeks. They are seemingly executing well, remaining legal issues seem to be dissolving, and the stock is near 52 week highs. More to say next month after earnings but this commercial play is chugging along for now.

#9: Iteos Therapeutics (ITOS) [Last Month: NR, ⭐️]

See the recent podcast for rationale!

#10: Chimerix (CMRX) [Last Month: 7, ⬇️]

No news now and still waiting on a mid-year update on Phase 3 enrollment and any news on their other pipeline assets. Honestly I’m bored here and I’ll probably bump this down and off the Top 10 to be leapfrogged by something else with more near-term potential. I think I’ll hold what I own but not adding yet unless something materially changes.

Falling out of the rankings: Aerovate (AVTE), Alpine (ALPN)

On Aerovate, some smart people expressed it was perhaps a riskier Phase 2 readout than I thought and clearly the binary downside is huge as a single asset company. And I have a lot of ideas I like right now with less risk. On top of that, how much will it really go up on Phase 2 results? Plus, PVR reduction and 6 minute walk test are extremely variable and somewhat random endpoints. What if one of those two measures comes in below expectations even if it is a good molecule/formulation? What ARE expectations anyway? (I have seen wildly different numbers expected for a “win” here.) I just changed my mind and am in wait and see mode currently. I don’t like to change my mind but something in my gut wasn’t sitting right. Now, watch it be a home run and go up huge. :-)

On Alpine, acquired like I thought it could be! Great result for investors, including me! What a fun ride, my only regret is not owning more and trimming as it kept running. Prudent risk management but I wish sometimes I was more recklessly risky like in my younger days when I would hold 30%-40% position sizes.

That’s it. Sorry for any editing or clunky sentences, had a lot of family things to attend to this month that grabbed my attention so basically slammed this out super quick. Forgive me if anything just flat out doesn’t make sense - you get what you pay for! :-) And as always, not financial advice, etc. just my thoughts on the space and my personal investment choices.

All the best,

Matt

hi matt, my wife and i care for my 3 year old granddaughter who was recently diagnosed with type 1 diabetes,.., she is on omnipod 5 and dexcom g7 which is kind of like a beta testing study using that combination of omnipod 5 and dexcom g7 ( the dexcom g6 was the one fda approved for omnipod 5)... so far so good... wonderful to no longer having to do fingersticks and multiple insulin shots each day... my daughter happens to be a pharmacist as well... our granddaughter was also diagnosed with celiac... has antibodies to the beta cells in the pancreas as well as the celiac antibodies.... apparently the combination of type 1 diabetes and celiac coexists in about 6 percent of the population... tough diagnoses for a 3 year old but we are doing the best we can to keep her healthy and to have a happy life... steven vig