Disclaimer: Not investment advice. Do your own research. For informational purposes only. I reserve the right to change positions after publishing as events change. Position rankings are accurate as of 2/28/24.

Hello, this is my monthly update on my top biotech positions. I’ll keep it short and sweet here at the top: very low turnover with only one new name entering the list this month. That’s great! That means every new idea I’m finding isn’t impressing me more than what I already hold. I do think a few names at the bottom of the list will be disappearing soon when they either go up or down after upcoming catalysts. I have a few names I’m doing more diligence on with hopes to add them to the Top 10.

But for now I tried to add new information I have obtained in the last month on these names since you are seeing almost all for the second time now.

My Current Top 10, By Position Size

#1: Cullinan Oncology (CGEM) [Last Month: #1, ↔️]

Six programs in the clinic, three data readouts this year, and the market finally woke up to the potential of CLN-978 in autoimmune disorders. That program will have a Phase 1 readout in B-cell NHL in early 2025 but there will be biomarker data regarding B cell depletion that can be applied for future decision making on a future autoimmune pivot or partnership. CLN-619 initial combination data in various cancers in June should be interesting and it looks like the Zipalertinib program in exon20 NSCLC is executing with a high probability of collecting milestone payments in the next two years. Oh yeah, CLN-049 in R/R AML data this year, CLN-418 in various solid tumors data this year, CLN-617 Phase 1 data as a pan-cancer therapy in 2025…well, you’ve heard this from me before. And even though this is no longer trading under cash there is still a lot of cash on the balance sheet and likely even more to come with obtainable Zipalertinib milestones.

#2: Alpine Immune Sciences (ALPN) [Last Month: #3, ⬆️]

Incredible stock performance. Still a lot of upside but I have been selling a little bit. I mean how can you not? Still, if all the data updates are encouraging this year (1H 2024 update in IgAN, 1H 2024 initial data in cytopenias, 2024 update in PMN, 2024 initial data in LN) there is definite acquisition potential here. This could be one of the next mega blockbuster drugs in immunology. So I’m just kind of holding, waiting, and enjoying the ride…so far so good.

#3: Edgewise Therapeutics (EWTX) [Last Month: #2, ⬇️]

Edgewise is a muscle-focused company with a $1.5 billion market cap but I’m increasingly seeing it almost as two companies inside one shell. Both programs emerged from the same platform but failure or success in one shouldn’t affect the other and both have blockbuster potential. Two separate uncorrelated bets: one in muscular dystrophy, one in hypertrophic cardiomyopathy and both will have proof-of-concept data this year. For muscular dystrophy, two year open label data in Becker Muscular Dystrophy in Q2 2024 and the first placebo-controlled Phase 2 in Q4 2024. The Q2 data will strongly inform the Q4 data’s chance of success. In cardiovascular, Phase 1/2 data in Q3 2024. I have seen some people push on the valuation here at $1.5 billion and I have to push back because I actually like both programs quite a bit and even led a very bullish KOL call on muscular dystrophies for Slingshot Insights. So this stays in the Top 5 for now.

#4: Celcuity (CELC) [Last Month: NR, ⭐️]

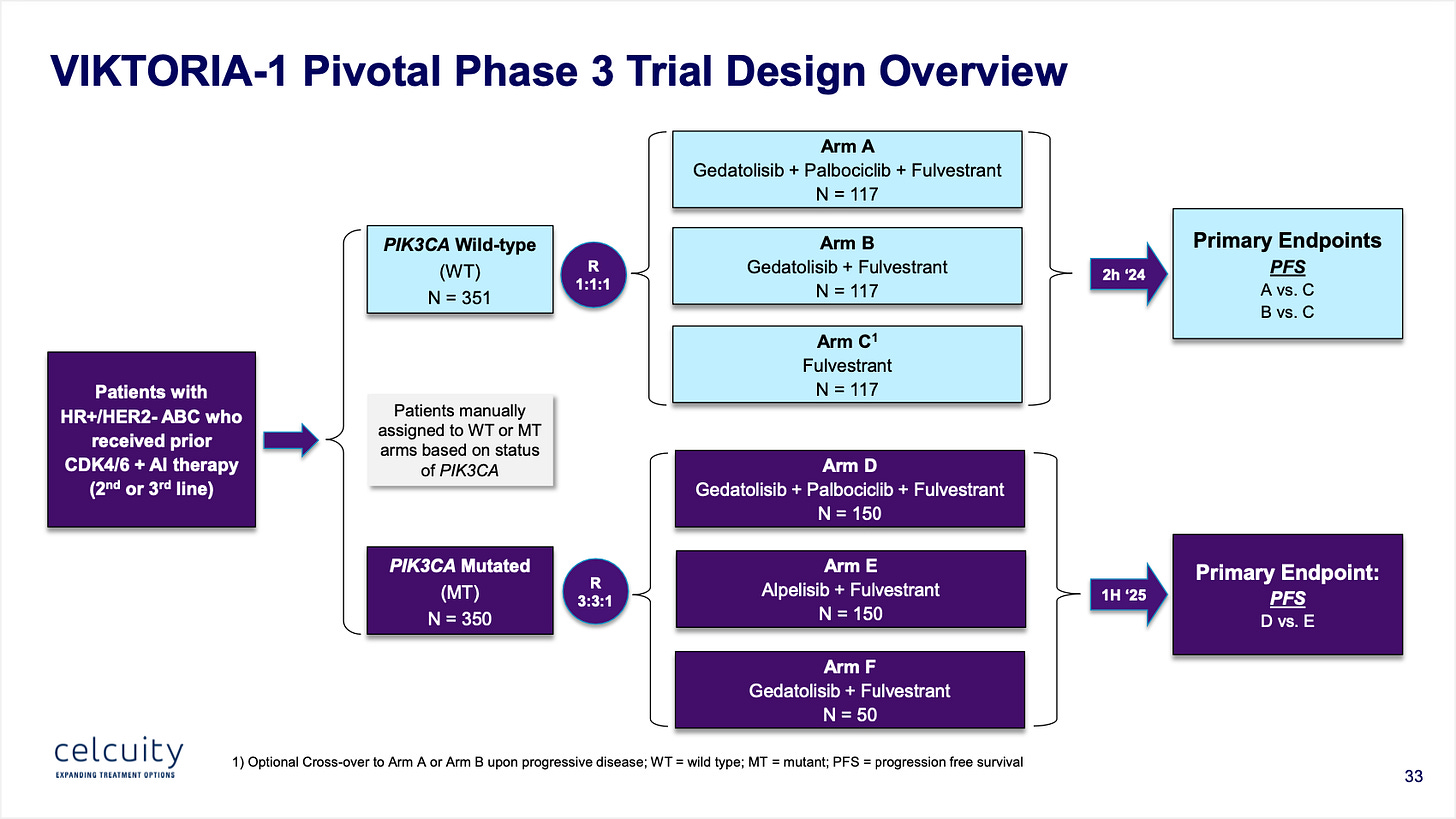

A biotech investor I respect very much (you know who you are, thank you) suggested this as an idea to me and when I dove in, I loved it. Now by the time I was able to reach out to him it was kind of too late to really give it the full write-up and time that it deserves. But since I was doing the rankings I wanted to include it and a full explainer of my thinking will be coming hopefully no later than the end of March. The company has three trial readouts coming: Late 2024 Phase 3 in HR+, HER2- PIK3CA WT 2L/3L Breast Cancer, Early 2025 Phase 3 in HR+, HER2- PIK3CA MT 2L/3L Breast Cancer, and Early 2025 Phase 1b/2 in post-AR mCRPC. Of those readouts, I think the Late 2024 readout has the highest probability of success so I definitely like the sequencing of events.

But, hey, here’s a teaser below from a conference presentation that I personally transcribed myself because I couldn’t find a transcript online. This confidence shows why I like the company so much and the opportunity for a quick re-rating of the company valuation:

CEO = Brian Sullivan, CEO, Celcuity

UR = Umer Raffat, Evercore ISI

Unintroduced Analyst = Evercore ISI Analyst who did not introduce himself.

UR: The thing that I sort of struggled with a little bit as I’ve looked a lot of your data sets they look fairly straightforward on PFS comparisons and yet I find the interest on the next gen SERDs or degraders to be a lot more than what I’m seeing here in spite of some of the data that you’ve been able to able to put up and there’s a lot more anticipation that datasets will become something but they’re not there yet [crosstalk] why do you think that is…

CEO: I think sometimes hypotheses take their own--create their own momentum. And you have six companies out there promoting this idea. So you’ve got a lot of-

UR: Have you seen a very clear dataset that…

CEO: No.

UR: …just anyone can actually track the type of PFS that you’ve been able to…

CEO: No.

UR: Let’s just talk about the 12 month PFS…

CEO: No.

UR: …in 2L/3L setting.

CEO: I think that would be very, very unlikely. I really don’t see any data that suggests that…

UR: …because there’s orders of multiple difference in valuations between you and if you add up the…

CEO: Look. That’s why you guys are here.

Unintroduced Analyst: He’s like I know.

CEO: I do know.

#5: Fulcrum Therapeutics (FULC) [Last Month: #7, ⬆️]

No news and waiting on October data. I have sold a bit but the appreciation of the share price means this moves up the rankings. Quite a run from the nadir at $2 to over $9/sh now. Followed it for years so sticking it out through the pivotal data in October.

#6: Delcath (DCTH) [Last Month: #4, ⬇️]

I was discouraged by an investor conference appearance in early February where the CEO was preaching caution and how slow the launch might be but then weeks later the company has 7 sites screening commercial patients so they have sandbagged me yet again! I’m pleasantly surprised. Still need to address the cash cushion and rolling over the debt (the CEO says he does not want to dilute at this valuation) but the $10 million in sales goal per quarter to unlock the remaining warrant redemptions is now in sight for this year…possibly as early as Q2 2024? Assuming the stock rises about $6/sh which it SHOULD if they are selling $10 million per quarter in product. It seems like good things are happening but I always preach caution with this name. It is a true micro cap stock, more so than any of the companies on this list. There is obviously 10-bagger potential here though. It’s a commercial stage name, too, which is nice, as are my next two companies on the list.

#7: Avadel (AVDL) [Last Month: #5, ⬇️]

I recently did a KOL call on Avadel’s Lumryz launch and maybe it splashed a bit of cold water on my extreme bull case (for now) but it still was positive. The KOL thought the oxybate market was very durable (“No, the oxybates are here to stay, and they are very likely going to expand into the other conditions I told you about.”) and no new mechanisms would usurp their place over at least the next decade. Also, they thought the market would expand from 16,000 patients to roughly 25,000 patients like the company has said. (“I agree. In fact, I think the market is probably larger than that. In narcolepsy alone, that number is probably right.”) Regarding the concept of discontinued patients getting reinterested in oxybate therapy: “A real phenomenon. That certainly is happening.”

The only real downside was they predicted Avadel’s market share of the 25,000 narcolepsy patients to be around 20%, instead of the 50%+ the company’s internal surveys predict. Still, 5,000 patients at $120,000 net pricing is $600 million in sales per year putting this at a valuation of 2x peak sales in narcolepsy alone with patent protection out to 2042. And the KOL was most bullish about label expansion opportunities in Idiopathic Hypersomnia which they called a better fit for the product profile and would also be a market size of around 25,000 patients total. If they are being too conservative on narcolepsy, you could easily see each indication having 10,000 patients on therapy for 20,000 patients total and $2.4 billion peak sales across all indications. That’s the extreme bull case but I’m still wanting to get more input to see what the narcolepsy market share will realistically end up at in five years.

I await the next launch update because I do feel the company will be profitable faster than analysts are modeling. And once they become profitable maybe they will start to get more credit in their valuation for future growth potential.

#8: Coherus (CHRS) [Last Month: #10, ⬆️]

I challenged Coherus to execute last month in a bit of frustration and I have no complaints so far this month. Their PD-1 is on the market for NPC (nasopharyngeal carcinoma), their Udenyca ONBODY presentation is now on the market with no legal challenge from Amgen yet, and while I didn’t like the pivot away from non-core assets I have accepted it and am just ready for them to sell Yusimry and clean up the balance sheet so I can start more accurately modeling the new company. I’m really curious to see if Amgen has a leg to stand on when it comes to blocking the ONBODY presentation of Udencya which seems like the first large-market truly differentiated product the company has had in their history. It’s a great bit of engineering, too, so kudos to the team who designed this.

#9: Fusion Pharmaceuticals (FUSN) [Last Month: #8, ⬇️]

Honestly just on a helluva run heading into the April data. The valuation is getting to the point where the upside is getting smaller and the downside if the safety profile disappoints is getting larger. But I can’t let it go completely. At one point this was my #1 position but I keep selling it as it goes higher than I could have imagined pre-data. Basically what I have left is found money covered by the profits I have taken but can’t let it go completely.

#10: Glycomimetics (GLYC) [Last Month: #9, ⬇️]

Even though I have been selling shares of the company as part of my general derisking and increasing my cash holdings, this still managed to stay in the same spot. Nothing’s changed really…still waiting on some data…any data. Still super risky, still intriguing upside. It’s basically tripled from the lows. If you have held it since then it’s your call what you want to do but I don’t think anyone would blame me for selling more than half as risk management. I’m trying not to be too greedy.

Falling out of the rankings: G1 Therapeutics (GTHX) [Last Month: #10]

G1 went on a +25% run the first week of February on top of a huge January 2024 so I sized down a bit. Then I led a KOL call with Slingshot Insights where the (excellent) KOL expressed skepticism the trial would be stopped early for efficacy. So I sized down more. Then I remembered how interim analysis for small biotechs just rarely if ever seem to meet the stopping criteria for efficacy and I sold a bit more still. I guess I wish I had sold all of it before they announced the trial would continue to the final analysis and the stock went down 40%. It would have felt like a coup to sell all my shares at the absolute top (I truly wish I could say I did!) but that’s how it goes. The final readout is in Q3 2024 now and it could still hit but I’m skeptical, along with the market.

Like I said earlier I have 10-15 names I’m still diligencing but they are either too early, too risky right now, or I just simply don’t know enough about the landscape yet to make an intelligent decision. But the ideas are flowing and occasionally people send me one which is nice, too, even if it is not always my style. Sorry if I don’t always respond to an email but I usually see it. Twitter is probably the best place to interact and follow for thoughts more than once per month.

Thanks for reading!

Matt

Do you still stand with Ocup?