My Top 10 Ideas As Of End of March 2024, Part 1

Disclaimer: Not investment advice. Do your own research. For informational purposes only. I reserve the right to change positions after publishing as events change. Position rankings are accurate as of pre-market 3/25/24 when writing was completed.

No time to waste this month as there has been some significant changes and if you have been reading the last two months you already know the deal so let’s get into it!

I hate writing intros anyway.

NOTE: This email became SO LONG I had to split it into two parts.

Positions #1-#5 will be today. Tomorrow will be #6-#10, plus the companies that fell off the list.

My Current Top 10 Biotech Positions, By $ Value

#1: Celcuity (CELC) [Last Month: #4, ⬆️]

I promised a full write-up last month after a teaser and since this is now my #1 position here we go. The crux of my thesis revolves around eight main points:

Point 1: Alterations in the PI3K/AKT/mTOR (“PAM”) oncogenic pathway occur in at least ~38% of breast/prostate cancers.

It has been known for decades the importance of the “PAM” pathway as an oncogenic driver that promotes tumor cell proliferation and affects immune system responses but no drug which inhibits the entire pathway has ever been approved because…

Point 2: No one has ever safely, effectively, and completely inhibited the PAM pathway.

The slide briefly sums up the long history of development in this space. One of the bear arguments is skepticism that Celcuity has in-licensed the first PAM pathway inhibitor that can be given safely but I will address that later, let’s first acknowledge how valuable an asset this could be if they can do what they say they can do. Celcuity believes their inhibitor, gedatolisib, could be the first to safely inhibit the entire pathway.

Point 3: Piqray, which inhibits only one of the four isoforms of PI3K, does not affect mTORC1 or mTORC2, and is highly toxic, annualizes at $500m in sales per year.

In the slide above, the 3rd gen drugs that were tried in this space yielded one approval in the 2L HR+/HER2- advanced breast cancer space, Piqray, which inhibits only PI3Kα isoform but still does a high amount of sales considering it has a considerable toxicity profile, limited survival benefit, and it is only on label for PI3Ka MT 2L HR+/HER2- patients.

Point 4: Celcuity’s gedatolisib has shown acceptable safety with room for further Adverse Event reduction while completely inhibiting the PAM pathway.

The most frequent AE in the Phase 1 trial was stomatitis which will be addressed with a prophylactic steroidal mouth rinse. The most watched adverse event will be hyperglycemia. Piqray has rates of 39% with 26% of patients having Grade 3 hyperglycemia. Compare that 26% Gr3 rate to 1% in the gedatolisib Phase 1b. I have seen skepticism that low level of hyperglycemia will hold but between the drug being IV, vastly lower total dosing than alpelisib (Alpelisib dosage per month is 22x gedatolisib), and lower volume of distribution I find the drastically reduced rates of Gr3 hyperglycemia plausible.

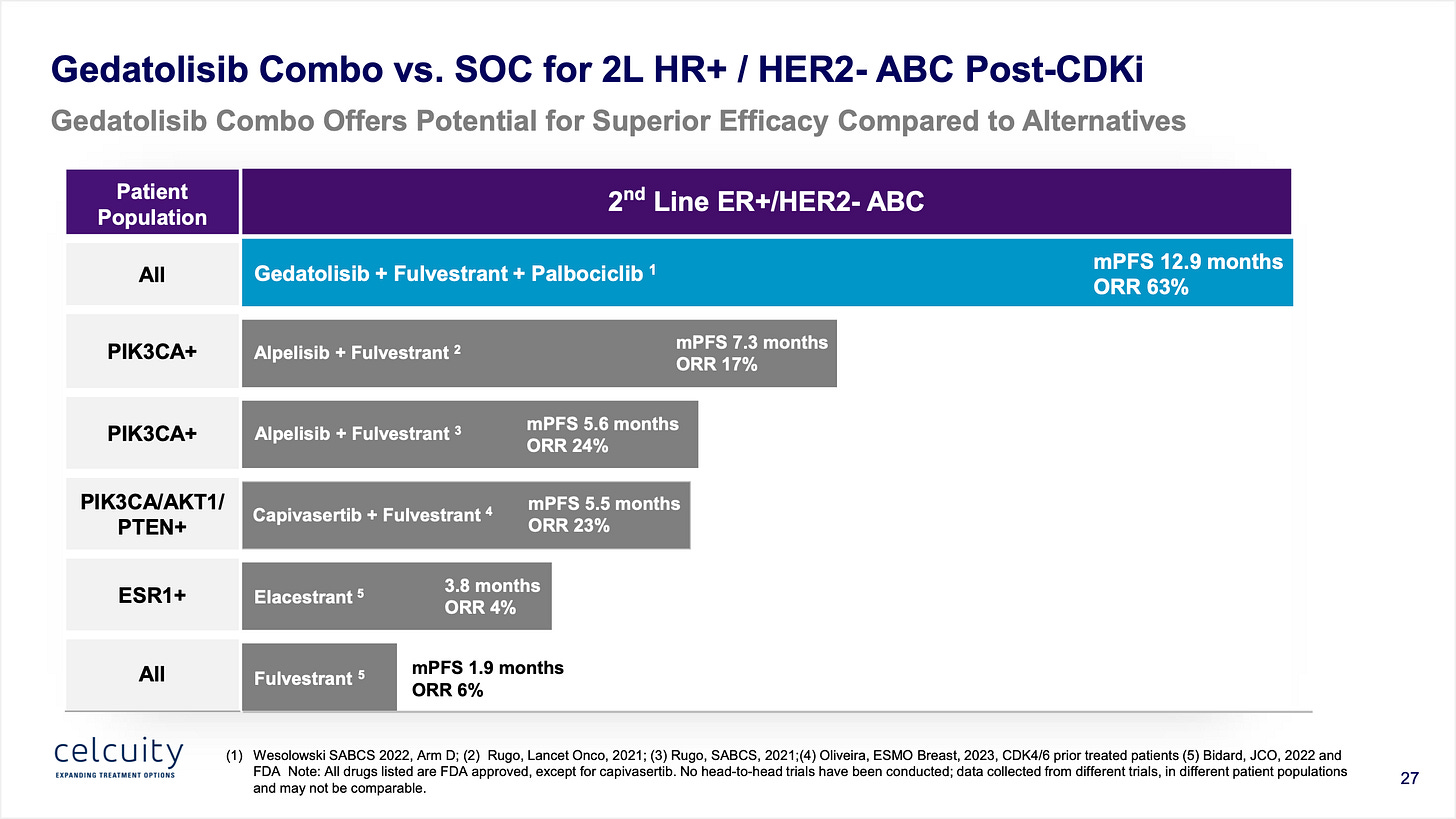

Point 5: The standard of care in 2L HR+/HER2- advanced breast cancer is ripe for disruption and relatively wide open commercially for such a prevalent oncology indication.

I believe the Gedatolisib Phase 3 has a high Probability of Success not only due to the excellent results it posted in the Phase 1b but because of how low the bar is in 2L HR+/HER2- WT cancer…which, thankfully, will be the first part of their multi-arm Phase 3 to read out. Let’s get into expectations both for the active arm and control arm…

Point 6: Phase 1b results show progression-free survival far beyond the SOC in both wild-type patients and PI3Ka mutant patients.

I read a KOL interview that claimed the Phase 1b results were a little confusing so let me try to explain the four arms as best I can. Arm A was in 1L patients. Just forget that exists for now, although the results were excellent but not relevant at the time being although possibly relevant down the road for label expansion. Arm B was in CDKi-naive patients, throw that out also because it won’t be relevant to the Phase 3 or the real world really where these patients rarely exist. Really what we are looking at are Arms C and D in 2L/3L CDKi-pretreated patients which aligns with the study population in the Phase 3. Now Arm C has a mPFS of 5.1 months and Arm D has a mPFS of 12.9 months. This is a bit confusing and can’t be fully be explained by the dosing schedule changes especially because Arm D is actually a lower dose of medication. (Although perhaps that helps with patients staying on the drug and not dropping out of the study.)

Arms C and D had some key differences: There were more WT patients in Arm C vs. Arm D (75% vs 56%) who would be expected to have a shorter PFS, much more prior chemo treated patients in Arm C (46.9% vs 18.5%), more median lines of therapy in Arm C (2 vs 1), and a shorter duration of immediate prior therapy in Arm C (5.2 months vs. 13.5 months). All of this is to say the Arm C patients were sicker. The Phase 3 will be enrolling patients with NO prior chemo and generally healthier but let’s just take this all at face value and average Arms C and D because I don’t want to be in the excuse making business. Arm C had 28 evaluable patients and Arm D had 27.

Combined Arms C and D: 33% patients with prior chemotherapy, 9 months PFS, 50% ORR with 65% of patients being WT and 35% of patients being mutant.

Based on a little basic math I think we can work out that in this patient population the WT patients had *roughly* 8 months mPFS and the PI3Ka MT patients had *roughly* 11 months mPFS.

The bar is 1.9 months for fulvestrant in WT patients, and an average of 6.5 months with alpelisib (Piqray) + fulvestrant in MT.

So putting it all together: the expectations if things hold steady would be that gedatolisib would get 8 months PFS in WT patients vs. 2 months for fulvestrant and 11 months PFS vs. 6.5 months for alpelisib + fulvestrant in PI3Ka MT patients. Both impressive increases but the effect size is larger in the WT patients which is good because that’s the part of the trial that reads out first.

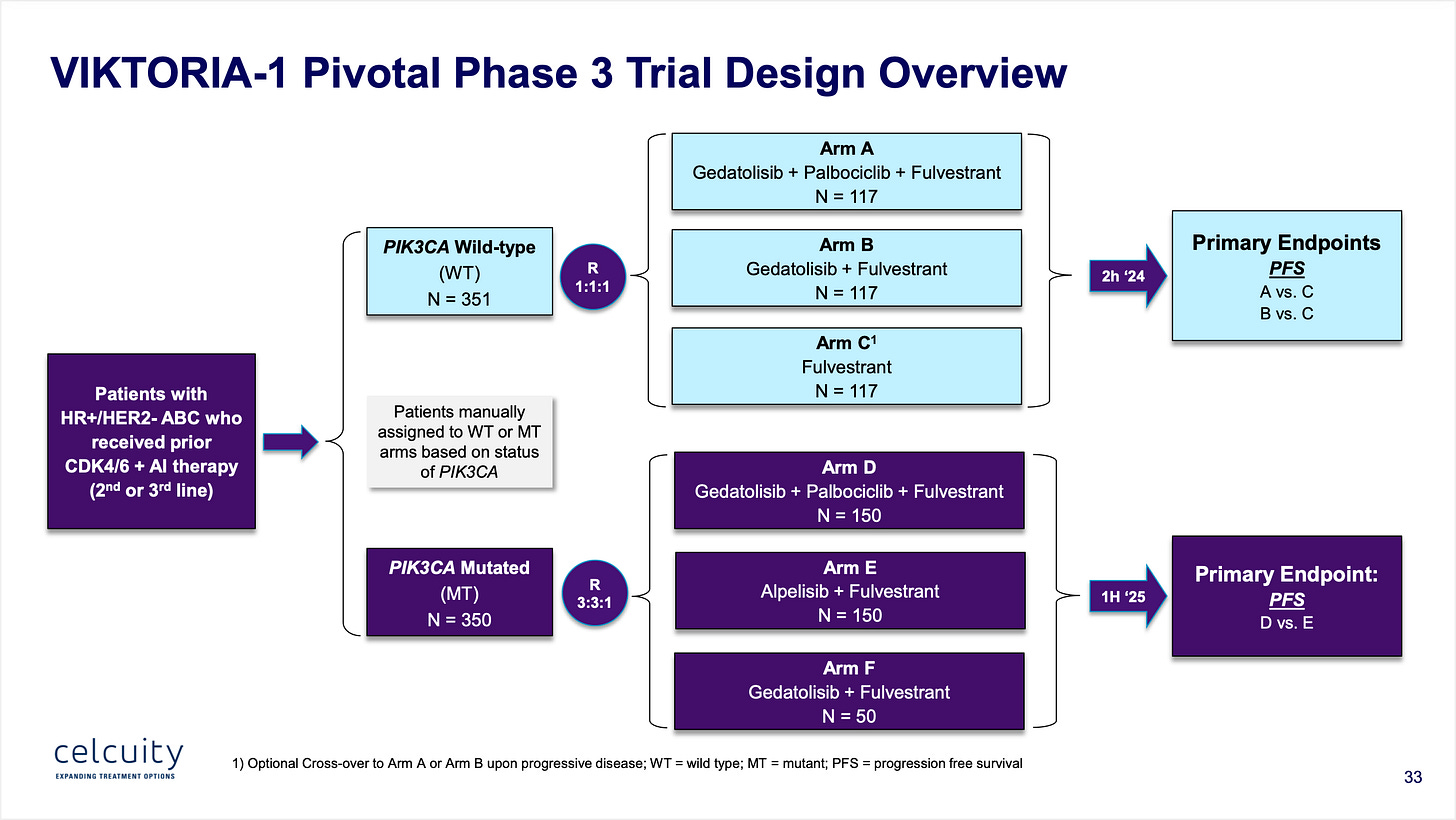

Point 7: Celcuity’s Phase 3 trial is designed to show contribution of effect making it unequivocally clear if the drug works as monotherapy and if it re-sensitizes to CDK4/6 inhibition.

I’m realizing I omitted one key point above. The results I showed were not monotherapy. (Keen readers of the slides probably picked up on that!) They were actually a triple combo of gedatolisib + fulvestrant (the SOC) + palbociclib a CDK inhibitor. Why add a CDK inhibitor for patients that have progressed on one? Because part of the theory of gedatolisib is that it will re-sensitize a patient to CDK inhibition. But the Phase 3 will also look at just gedatolisib + fulvestrant alone to show contribution of effect to prove that is not just palbociclib driving the benefit.

(You wouldn’t expect this from re-treatment with a CDKi but it’s good to put that theory to bed entirely for regulatory concerns.)

The multi-arm trial will test doublet and triplet regimens and should be incredibly overpowered due to the large effect size seen in the Phase 1b.

Point 8: Further markets exist including 1L advanced breast cancer (48.6 month PFS), mCRPC, and more.

I have already spent a considerable amount of time here and the core thesis is 2L advanced breast cancer but as mentioned earlier there is incredible data in 1L advanced breast cancer (the only drawback there is patients lived so long they would have to be on a 3x/monthly IV medication for years and years…), metastatic Castration-Resistant Prostate Cancer (where the standard of care is now radiopharmaceuticals and could be disrupted if comparable survival was demonstrated) and possibly even other indications that involve the PAM pathway. 2L breast cancer needs to work for the company to be viable but if it does work I think there is some legitimate “pipeline in a product” potential down the road and depending on the competitive landscape.

#2: Edgewise Therapeutics (EWTX) [Last Month: #3, ⬆️]

No real surprises from the recent earnings release, things seem to be moving along on track with all trials enrolling on pace or on schedule to initiate on time. Open label data out to 24 months from the Becker Muscular Dystrophy program in Q2 along with placebo-controlled exercise challenge data and first open label data in Duchenne Muscular Dystrophy. For the cardiovascular program, Phase 1 data in Q3. A very catalyst rich period ahead with hopefully good news. We will see how the stock trades ahead of these events and how I want to be positioned but for now this is okay. My cost basis is under $10 due to some luck and even though the stock has pulled back a bit from the recent high near $20 it still seems to be relatively steady ahead of these catalysts.

One thing I posted on Twitter is that the placebo controlled Phase 2 for Becker Muscular Dystrophy overenrolled (69 patients vs. 40 originally planned) and while it is a near certainty to hit the Creatinine Kinase endpoint is seems they would now have some powering to show a change on the NSAA scoring rubric, as well. And the company has been more aggressively talking about how if they hit on the primary with trends on secondaries plus they have their Phase 3 study fully enrolled they could approach the agency about Accelerated Approval possibilities. It’s not a part of my core thesis but it has upside potential beyond what is currently expected from the muscular dystrophy side of their pipeline. (Which is to say it seems not much is expected from the muscular dystrophy side of the pipeline.)

#3: Fulcrum Therapeutics (FULC) [Last Month: #5, ⬆️]

Not much to report after the earnings press release and call. There seems to be some growing optimism around the SCD program which has driven share price gains but as a reminder I still value that program at $0 for now. I recently revisited the Phase 2 FSHD data and was still surprised how much confirmatory evidence there is to give me confidence in the Phase 3 readout. The stock has been one of the best performing in the biotech sector but it has pulled back a bit recently. For now this sizing is okay for me but if it pulls back further I may even be inclined to add some more.

#4: Cullinan Oncology (CGEM) [Last Month: #1, ⬇️]

The recent earnings release affirmed all previous timelines and there really isn’t much new to report here compared to what I have wrote about previously. No news is good news, first combination data in June for CLN-619, and progress on the rest of the pipeline. Maybe the best news of the recent press release would be confirmation the company is seriously beginning development in autoimmune disorders for CLN-978, their CD19xCD3 T-cell engager. It’s what the Street wants to see and I say give the people what they want. If it shows promise they might have to change the name from Cullinan Oncology to Cullinan Biosciences or something.

#5: Aerovate (AVTE) [Last Month: NR, ⭐️]

Aerovate is testing a tyrosine kinase inhibitor, imatinib, in pulmonary arterial hypertension. The crux of my thesis revolves around five main points:

Point 1: Systemic imatinib is proven to work in PAH but lacks tolerability.

The whole idea of using a TKI in PAH comes from the 2013 journal article cited below. In short, the primary and secondary endpoints hit but the safety profile of taking systemic imatinib chronically made the commercially non-viable. Aerovate is trying to bring back that idea with an inhaled version using the same TKI as Novartis used which is now off patent. Gossamer Bio is a competitor using a different TKI, seralutinib, with different selectivity but also the inhaled route of administration.

Point 2: Seralutinib showed signs of activity in their Phase 2 but lacked the effect size of systemic imatinib and also lacked a dose-ranging Phase 2 design which leaves a window open for superior data.

Seralutinib’s Phase 2 had issues. Pulmonary Vascular Resistance, a surrogate endpoint used in Phase 2 studies as a predictor of Phase 3 success in 6 Minute Walk test, was weaker in effect size than other previous PAH studies. Systemic Imatinib has shown stronger effects on PVR in both its Phase 2 and Phase 3. Also included below are the PVR results for sotatercept, a groundbreaking PAH medicine that should be approved shortly.

Imatinib (TKI) PVR reduction in Phase 2: -26%

Imatinib (TKI) PVR reduction in Phase 3: -32%

Seralutinib (TKI) PVR reduction Phase 2: -14.3%

Sotatercept (activin trap) PVR reduction in Phase 2, low dose: -18.5%

Sotatercept (activin trap) PVR reduction in Phase 2, high dose: -31.8%

Sotatercept (activin trap) PVR reduction in Phase 3: -21.4%

(I had to calculate this one myself from the journal article because Aerovate didn’t provide it in their deck but I think it’s right! If not, please send me correct figure with where I screwed up my math!)

Seralutinib blamed their results on a study population that was not as sick as other trials but I think there are unanswered questions about their molecule’s selectivity (or perhaps the benefit of having a less selective “dirty” molecule like imatinib) and their pharmacokinetic profile. They took only one dose into Phase 2 as opposed to a traditional dose finding Phase 2 with multiple arms or at least two arms with a low and high dose. Will this be a mistake? Time will tell. I believe Aerovate can very comfortably beat a PVR reduction of -14.3% but we will see. Anything around a -20% reduction in either the medium dose or high dose arm would be great I think and reflect well heading into the Phase 3.

One note someone smart brought up to me is that the company said they will release baseline characteristics of the study before releasing results. The sicker the patients, the more likely PVR endpoint will hit that rough -20% expectation. That is a potential stock moving catalyst even before the data.

Point 3: Safety of inhaled imatinib should be fine as systemic concentrations will be 1/5th to 1/10th of systemic imatinib.

Above is a graph of the systemic exposures of the inhaled doses tested in the Phase 1. As you can see even the highest dose tested in the Phase 1 90mg 2x/d was signficantly lower than systemic imatinib. The three doses being tested in the Phase 2 are 10mg 2x/d, 35mg 2x/d, 70mg 2x/d and I suspect the 35mg dose might be just fine based on other modeling work in their slide deck. But even assuming they need the 70mg 2x/d dose to gain maximal effect you can still see there is quite a bit less area under the curve compared to systemic therapy so hopefully tolerability will be much improved.

Point 4: Aerovate should benefit from an enrollment advantage compared to Gossamer Bio with nearly twice the sites currently active at publication.

Aerovate is doing a seamless Phase 2b/3 design and finished enrollment for the Phase 2b in November and immediately rolled over into enrolling their Phase 3. They have 121 sites currently active compared to Gossamer Bio’s currently active 61 sites. Gossamer as far as I can tell enrolled their first patient in December. This time period before sotatercept’s approval and launch in mid-year 2024 is crucial to getting patients in the U.S. enrolled in the study and I think Aerovate is in the best position currently. Strong Phase 2 PVR results will further get site investigators engaged in their study especially if they are significantly better than Gossamer’s.

Point 5: Inhaled TKIs in PAH have the potential to be a large market by being used in addition or in sequence to sotatercept so both be Aerovate and Gossamer Bio can be successful.

With all that said, I don’t think for Aerovate to win Gossamer has to lose necessarily. The market for a potential TKI is very large because I anticipate TKIs will be used either in combination or in sequence with the activin trap agents. PAH is a progressive and fatal disease and there needs to be more effective therapies with more mechanisms of action and more aggressive treatment overall. If the TKIs are effective and tolerable I suspect the market will be very large. I just personally feel Aerovate is more derisked based on the fact we KNOW imatinib works if you reach the target concentrations and I don’t feel seralutinib has definitively answered questions about the molecule or their PK profile to give me high confidence in a Phase 3 success.

TOMORROW: Part 2!

Thanks for reading,

Matt