Q1 Earnings Season Preview: Commercial-Stage Biotechs

EOLS, APLS, ARQT, GERN, HROW, SCPH, VRNA, AVDL, MDWD, SWTX, KNSA, DCTH, SRRK, CRNX.

Word count of 3,560, reading time of 17 minutes.

I’m switching up things this earnings season. For the commercial-stage names I thought I would do a PREVIEW heading into the next two weeks of earnings season.

I realize in the past I would spend time doing very detailed recaps days after the calls but by that time the market has digested at least part of the noteworthy information. With the goal of being early, I’m going to list proactively what I’m looking for on each call so readers can react in real time to positive or negative content of the call, hopefully before the market at large does. I’ll probably also do one comprehensive REVIEW post of what I liked and didn’t like from these earnings reports on May 12.

Commercial-stage companies I’m going to be watching this quarter include: EOLS 0.00%↑, APLS 0.00%↑, ARQT 0.00%↑, GERN 0.00%↑, HROW 0.00%↑, SCPH 0.00%↑, VRNA 0.00%↑, AVDL 0.00%↑, MDWD 0.00%↑, SWTX 0.00%↑, KNSA 0.00%↑, DCTH 0.00%↑ and I’ll throw in the soon to be commercial names SRRK 0.00%↑ and CRNX 0.00%↑ too.

Note: Substack is saying this post is too large for email due to the embedded pictures. If you don’t see my sign-off at the end of the article your email client likely cut off the bottom of the article. For best experience, view in browser or the Substack app.

My Three Favorites

Evolus EOLS 0.00%↑ - I know I have consistently talked about this company over and over again but I still don’t feel it’s anywhere near fair value so I’m going to stick with it as it is one of my higher conviction ideas. On the call the immense focus will be on the early response to the filler line specifically how providers perceive the differentiation of that line and how that has changed the rebating game. Even though the fillers were launched in April they were approved in February and run through a pilot program to select high volume accounts, any color on the experience there and the general reception in the first couple weeks of launch will be scrutinized. The revenue number is obviously important but in the past Q1 could sometimes be lower than the seasonally strong Q4 from the previous year. With possible economic weakening, I’ll be listening to management commentary on overall neurotoxin market growth - my theory is even in a recession millennials and Gen Z will prioritize their aesthetic appearance over other discretionary expenditures. But any contraction in the overall market would make Evolus’ growth aspirations much harder. Another important metric for me personally would be if account growth could stay hot. This is obviously an important metric for taking overall market share which the company has been growing at roughly 2% each year on an absolute basis.

The Q4 number of total purchasing accounts increased by 830 accounts - a very good chunk of the ~30,000 potential accounts that exist domestically. In the past the company has said that some accounts wouldn’t entertain adding them until they had a filler line. At the very least the filler line gives the field force a new reason to engage - but also now that the company is more than 50% penetrated in U.S. purchasing accounts it will be interesting to see if they can keep adding new providers at that hot, hot rate. I also would like color on international toxin revenue - it should still be pretty slow but they are now in multiple major markets and it would be nice to see some improvement. The filler line and international revenue are integral to helping the company reach their $700 million in annual revenue by 2028 goal. This is still trading at a 2x NTM P/S ratio with the company essentially profitable going forward.

Analyst estimates expect 72.4m, the previous quarter was 79m, the previous Q1 was 59.3m. Midpoint estimates pricing in 22% YoY growth.

Apellis APLS 0.00%↑ - Apellis stock has been trading awful the last couple weeks which leads me to wonder if there is something overall wrong with the Geographic Atrophy market that I don’t know about. But beyond the revenue number here will be the usual suspects on the ophthalmic side of the business - the growth rate of the overall market, market share of new starts, and underlying injection volume growth versus sales growth which became an issue last call with disclosure of larger than expected sample usage at the start of the year. Commentary re: the new messaging on differentiated efficacy and how it’s resonating would be helpful, too. Plus, what I’m sure will be lots of discussion on if their competitor’s more limited label is hurting them in the real world. On the systemic side assuring the market the PDUFA date will be met (it should - the FDA gave them a favorable review date, more near-term than it even needed to be) and continuing to educate the market on the size of C3G and Primary IC-MPGN as well as reminding listeners about the Phase 3 data that has the potential to be a best-in-class therapy. You would hope the market would realize this already but I guess these things take time. The good news is with a PDUFA action date of July 28, 2025 the company could see serious operating leverage as soon as the third quarter. Apellis is trading at a historically low 2.5x NTM P/S and now has 17.90% short interest - this company is being estimated like it will grow less than 10% YoY total in 2025 and I think the comps could get impressive starting with Q3. It’s the end of April, soon the market will begin re-pricing this if I’m right.

Analyst estimates expect 195.6m, the previous quarter was 212.5m, the previous Q1 was 172.3m. Midpoint estimates pricing in 13.5% YoY growth.

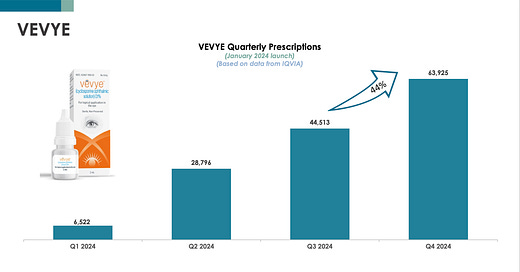

Arcutis ARQT 0.00%↑ - Arcutis has been on an incredible run, as shown below. QoQ growth greater than 40% for four straight quarters! That was fueled by new product launches in Seborrheic Dermatitis and Atopic Dermatitis. But they are even seeing some impressive growth in the Plaque Psoriasis launch which at one time looked to be pretty underwhelming. There is real evidence that the diversified product line is lifting all boats in terms of prescriber mind share and prescribing intent.

On the call I’ll be looking for…

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.