Q3 2024 Earnings Call Recap, Part 2

This is Part 2 of the paid subscriber exclusive long-form post for November.

Hello subscribers! Here is part 2 of your first monthly long-form article. As a reminder you will receive one long-form post each month, and that one to two extra paid posts of medium length. And then short thoughts constantly in the Subscriber Chat.

(If you are viewing this in email, you may want to view it in a web browser or the Substack app as this email is 8,069 words long and might clip off the end.)

(Also if you are NOT a paid subscriber, please take advantage of the free trial option. Cancel in 7 days if you want. Just see what it’s all about at least. Give it a try!)

As a reminder for November we are going through 15 quarterly earnings calls I listened to and read the transcript twice.

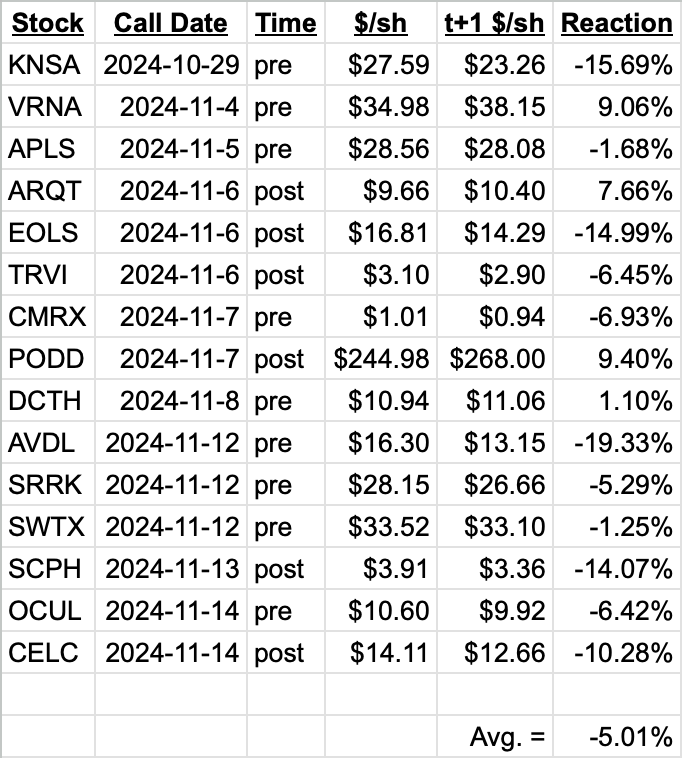

The companies covered this quarter: KNSA, VRNA, APLS, ARQT, EOLS, TRVI, CMRX, PODD, DCTH, AVDL, SRRK, SWTX, SCPH, OCUL, CELC.

The first eight were in Part 1, the second seven are below.

Subscribers if there is something you want me to cover more (or less) or anything you want added to this format, please let me know in the chat!

I’m going to likely add more commercial-stage companies next quarter and drop a few of the clinical-stage ones.

A quick reminder of the format…

There will be a template at the start of each company section:

NASDAQ Stock Symbol:

Company Name:

Earnings Call Date, Call Time:

Share Price Heading Into Call:

Shares Outstanding:

Market Capitalization:

Share Price One Full Trading Session After Call:

Stock Price Change:

Market Capitalization One Full Trading Session After Call:

…this will be followed by four sections of analysis…

Bottom Line Up Front:

Analyst Question Topics:

Pulled Quotes From Executives:

Additional Analysis:

The order of companies was determined by chronological order and if the calls happened at the same time then alphabetical order. In the end, it’s up to you to determine the worthiness of an investment or what weighting you should give it, if any. These are my opinions. I believe I have a very good track record but past performance is not indicative of future results.

Standard boilerplate disclaimer: I am not a financial advisor. This is not financial advice. This is not a solicitation to buy or sell securities. For research purposes only.

Here is a quick reference tracker of how all the stocks tracked this quarter reacted after one full trading session post earnings call. I just include it to show what the generalized Wall Street reaction was to the call. Obviously if you think the call was bullish but the reaction was bearish, that’s a buy. If you thought the call sucked but the stock went up, that’s a sell!

We can see the average earnings call reaction for these companies the next trading day was down -5.01%. In biotech bear markets, smaller companies have a reputation for earnings calls being “sell the news” events but really it’s hard to tell how much was really influenced by the election, the RFK selection for HHS, and what seemed to be a recurrent theme of slower summer seasonality for specialty drugs. (Although let’s be honest, it’s mostly the first two.)

Okay, let’s get to the breakdown of the last seven companies on the list!

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.