Reader Mailbag! Updates on CELC, DCTH, GUTS, GERN, and MNKD.

Please let me know if you like this feature so I know if I should keep doing it!

Word Count: 2,990 words, Reading Time: 14 minutes. Not financial advice, do your own due diligence, for entertainment purposes only.

Subscribers: Substack is telling me this post is too long for email so please load in browser if the bottom cuts off before my signature.

I have a number of topics I want to cover this week and luckily my readers have asked questions through DM or in the chat about all of them so how about a first ever edition of a reader mailbag…?!

I have cleaned up the questions a bit for readability and flow but the questions are actually real! ☺️

Q: What did you make of the Celcuity CELC 0.00%↑ data update?

A: The initial reaction to the Celcuity VIKTORIA-1 trial update released over the weekend was extremely puzzling. (Well, so was the initial reaction to the top-line data in July when I wrote an article basically pounding the table to add the dip at $38, see article below.)

It seems there are a contingent of people who just start with the assumption the company is overvalued and then try to work backwards from there. That’s the only conclusion I can really take from the pretzels they wind themselves in.

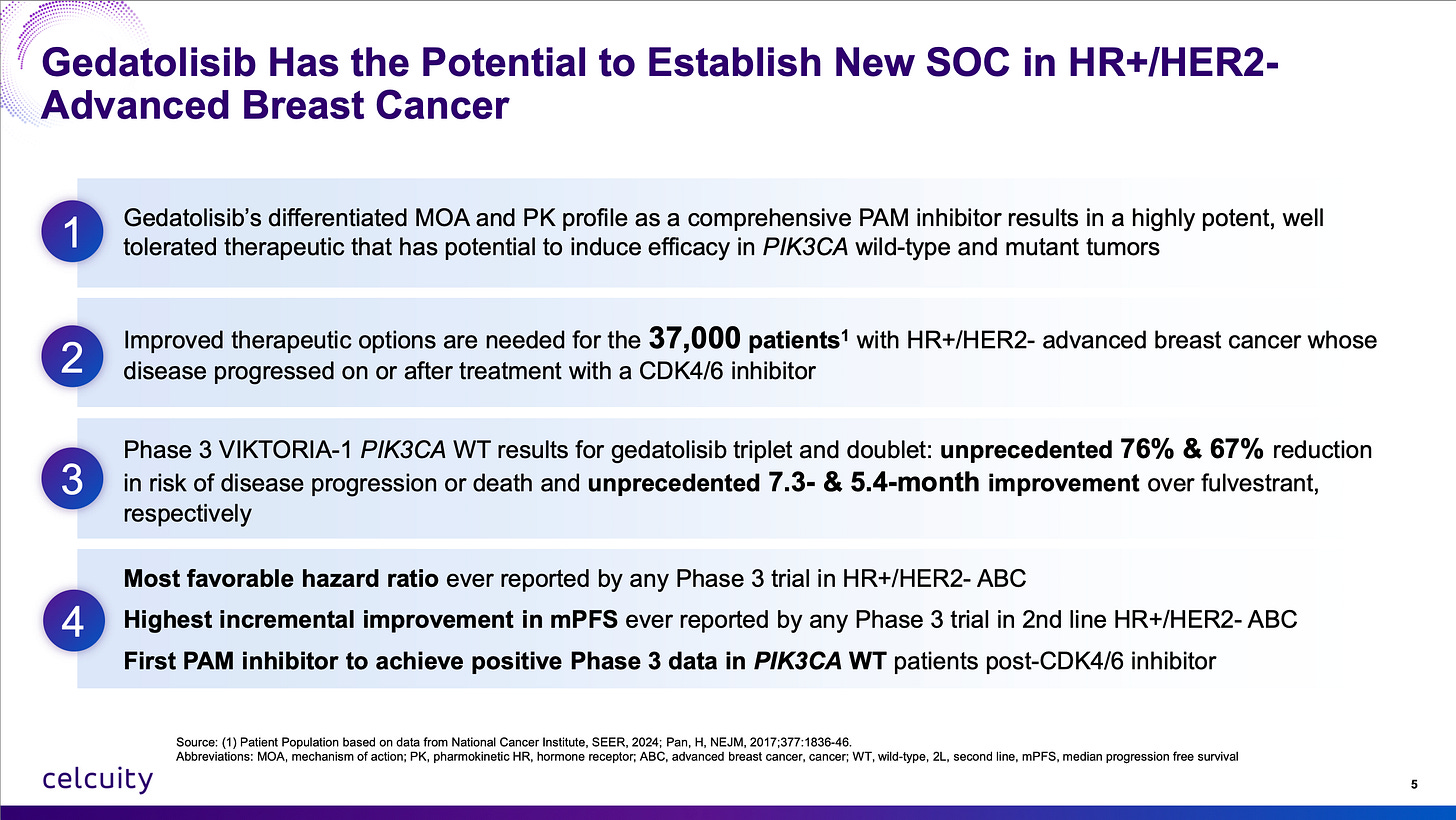

Here’s where I stand with Celcuity’s gedatolisib:

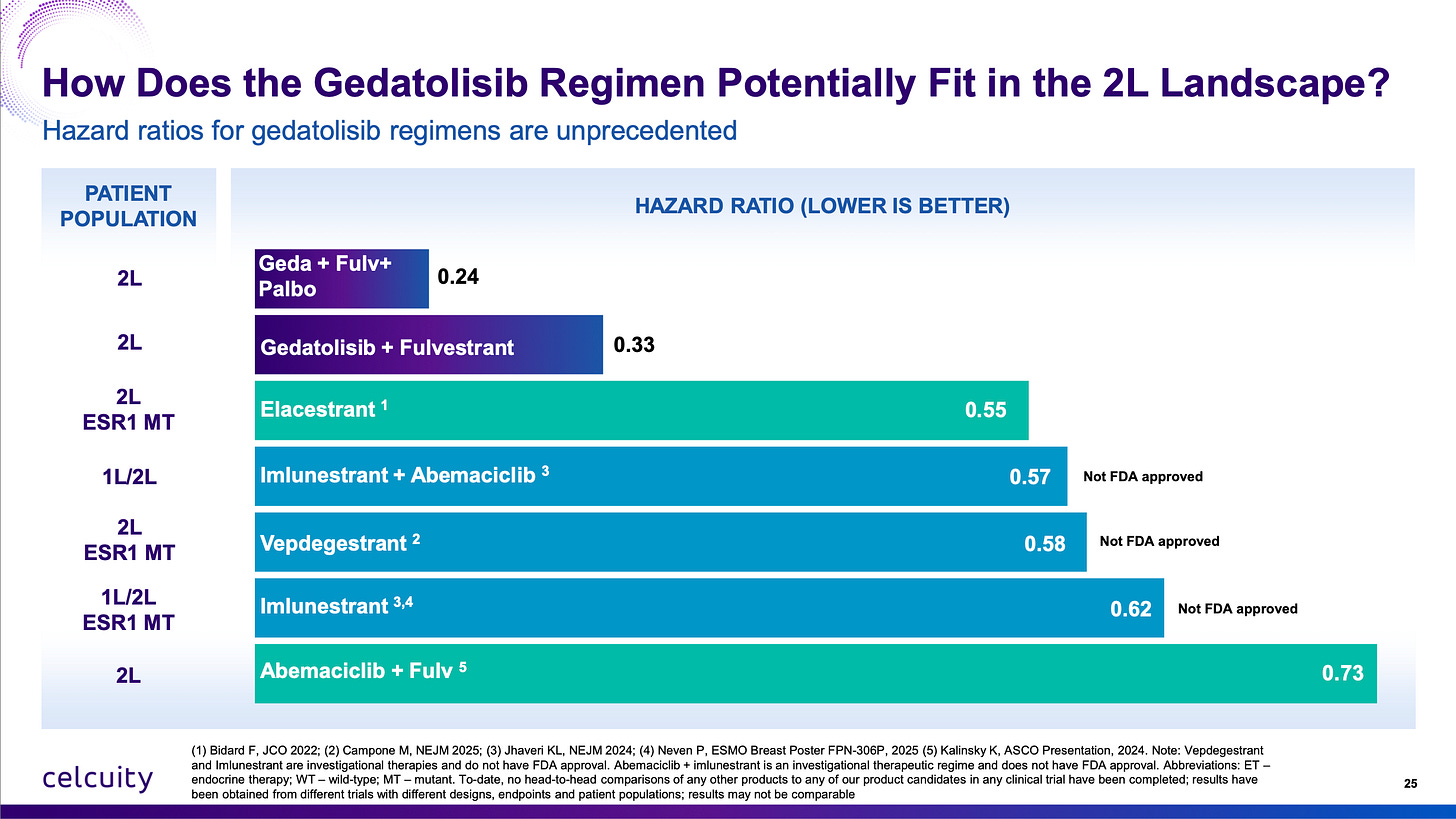

One of the most basic concepts in analyzing oncology data is contribution of components and hazard ratio. What is one specific drug adding and what does that addition actually mean to survival in relation to how sick the patients are?

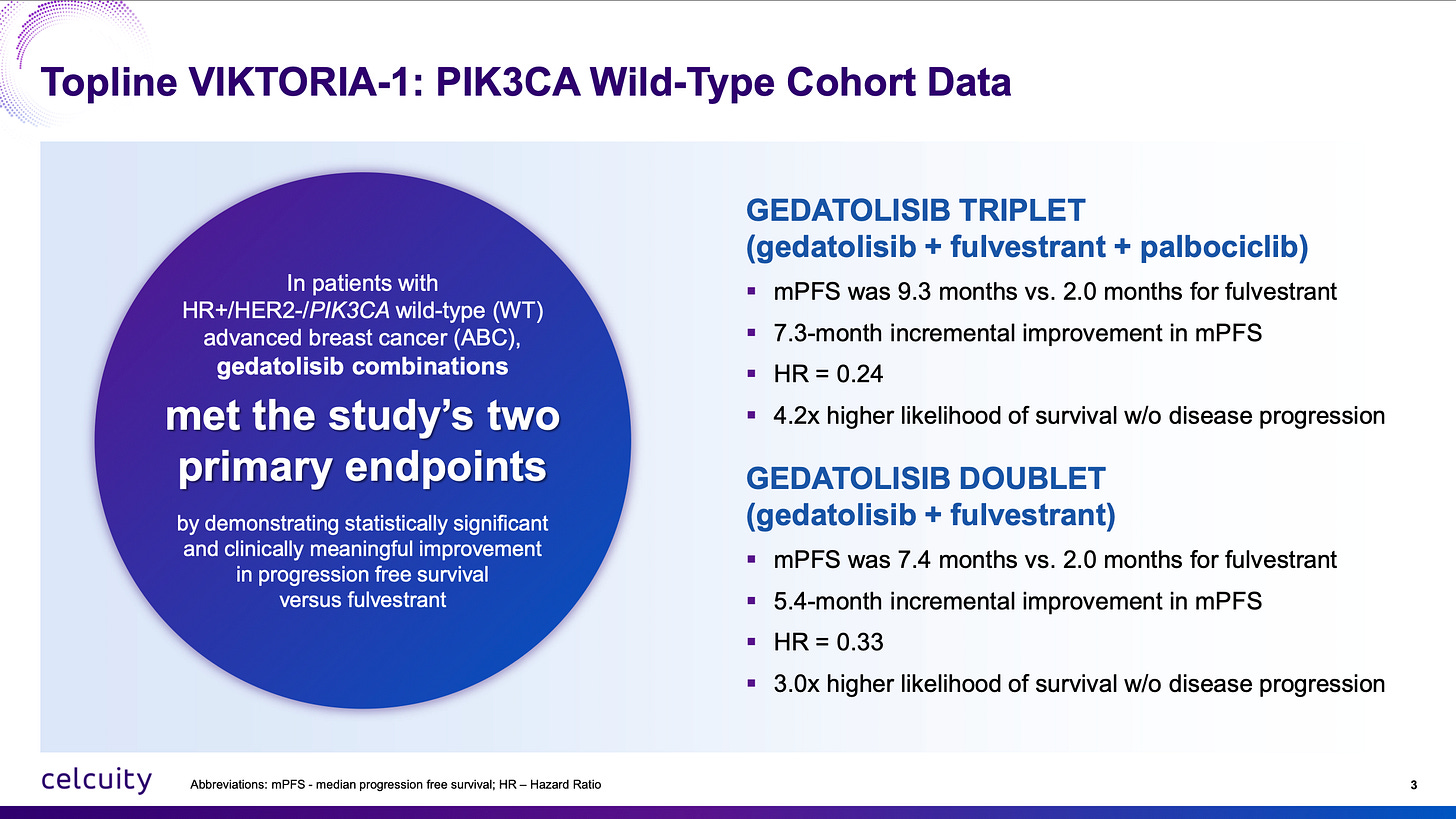

The first criticism I have heard about the VIKTORIA-1 2L trial is that the comparator is fulvestrant by itself and that’s not the current standard of care. Well, the VIKTORIA-1 trial was conceived in 2021 in accordance with FDA wishes. I’m not sure what people want the company to do when the FDA says this is the trial design we want for approval! Furthermore, even with the doublet regiment of just fulvestrant and gedatolisib, mPFS was 7.4 months vs 2 months for fulvestrant, a hazard ratio of 0.33 or 3x higher likelihood of survival without disease progression as seen above.

There couldn’t be more clear evidence that gedatolisib belongs to a new class of medicine that isn’t currently approved in PIK3CA wild-type 2L which now conclusively adds survival benefit. The triplet adds even more survival benefit, especially because CDK4/6 inhibitors added to fulvestrant aren’t expected to produce more than 1 to 2 months added benefit with re-treatment.

Furthermore, people want to make cross-trial comparisons that just didn’t hold water. “Is it competitive?” “Is it that much better than imlunestrant + abemaciclib?” “Is it better than the Roche giredestrant data?” YES YES YES YES YES YES YES YES YES YES YES YES. Look at the hazard ratios. The best way you can do a cross-trial comparison. Baseline characteristics, inclusion criteria, prior lines of treatment can vary wildly especially in breast cancer trials. But if you add one just drug to the comparator, how much better does survival get? (Or in the case of the triplet therapy, two drugs.)

Fulvestrant monotherapy is perhaps not what a patient would get second line in 2025 but these patients were sick enough that with fulvestrant by itself the median PFS was only two months. Fulvestrant monotherapy has been the control arm in many breast cancer trials and that PFS performance with this patient population’s baseline characteristics is consistent with the multiple other trials. The gedatolisib doublet and triplet arms are not a fluke. It is an extremely active oncology agent.

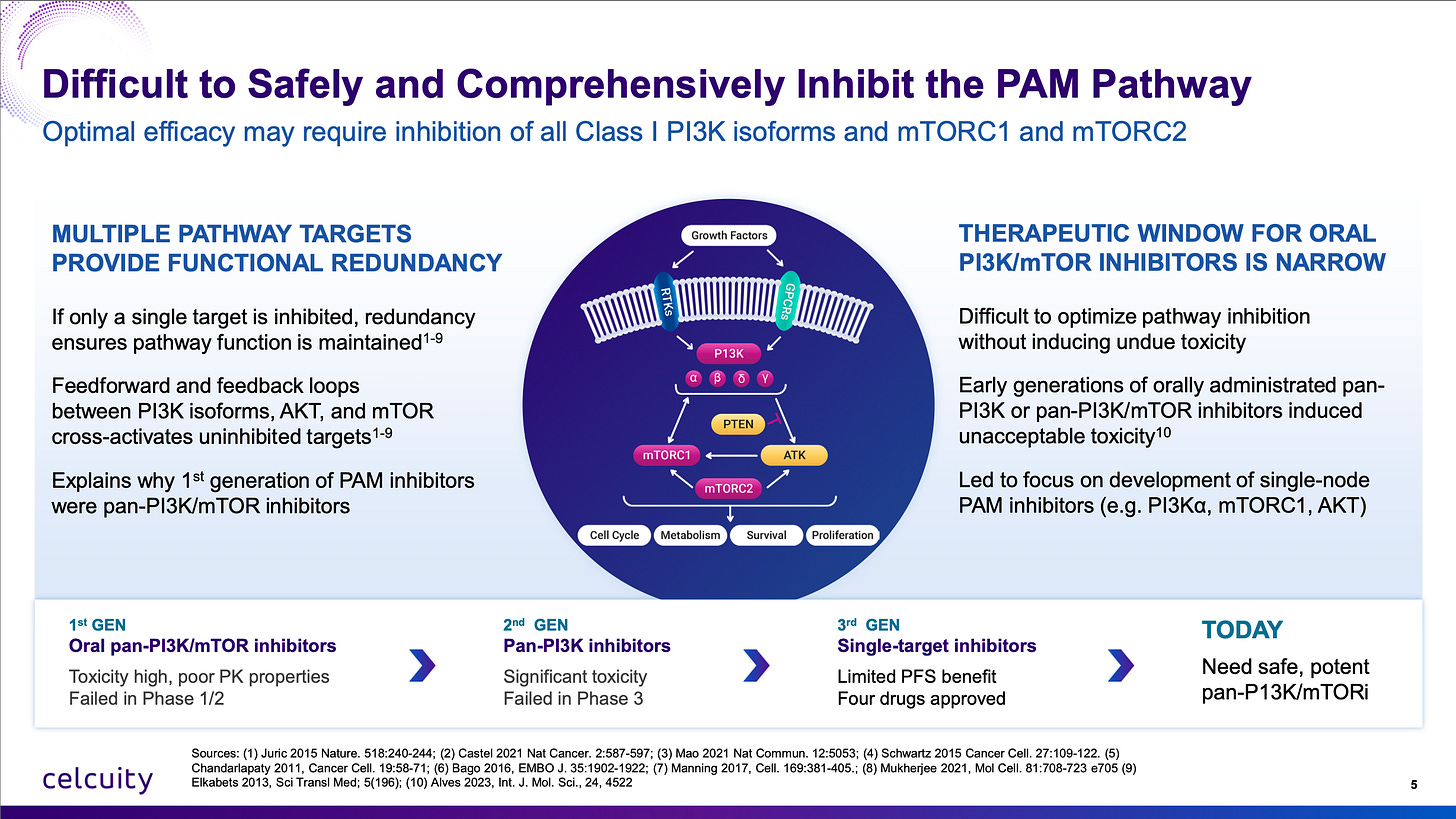

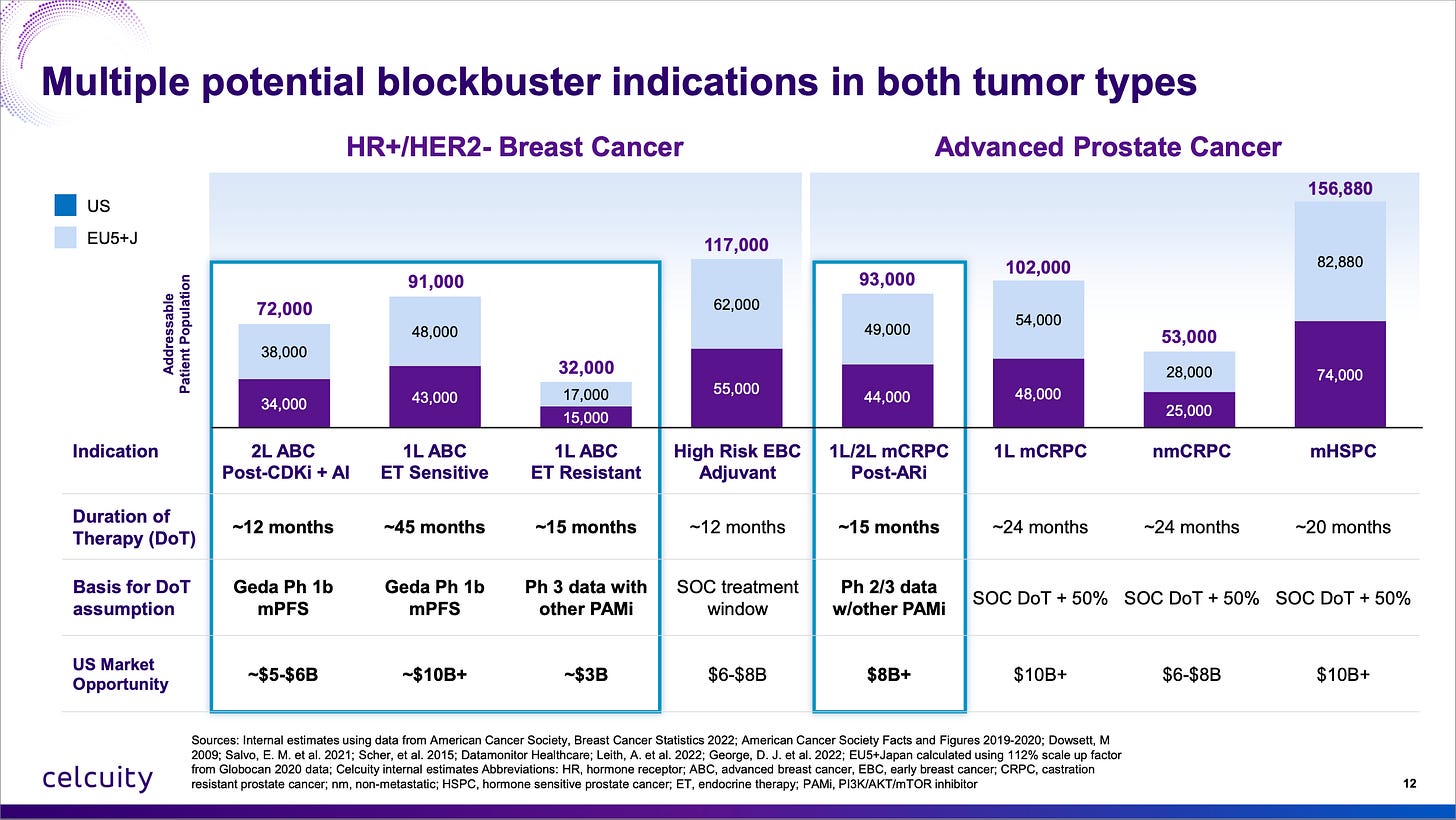

This is going to be a first-in-class approval in PIK3CA wild-type 2L advanced breast cancer of a novel mechanism of action. It is now proven to increase survival by adding it to the most basic regimen. There is no reason really you couldn’t add it to ANY best-in-class CDK4/6 inhibitor, selective estrogen receptor degrader, whatever, to get even better results. I get it, the oncology landscape is always rapidly shifting. The good news for Celcuity is there is really no drug out there that completely inhibits the “PAM” pathway (alpelisib only inhibits one isoform of PI3K) and ALSO nothing on the near-term horizon. They really resurrected a drug class that was left for dead by Big Pharma (licensed from Pfizer for $10 million upfront!) and achieved success when few thought they could.

It is very rare to find a differentiated asset free of near-term competitive threats in oncology, let alone in a massive market like advanced breast cancer.

What about the stomatitis? Higher than expected in the Phase 3 but less than 20% of enrollees had a ≥Gr3 event and the dropout rate for the study was extremely low so it didn’t affect their willingness or ability to get therapy. Also I suspect there was a lack of compliance with the mouthwash until stomatitis emerged. Better compliance could lead to lower rates in the real world.

What about the hyperglycemia? Lower than expected in the Phase 3, a mostly non-issue which is incredible given the history of Adverse Events with past clinical candidates in this space!

What about the IV administration? Another non-issue, patients will get infusions if their physician says it’s the best option and physicians can actually be incentivized to use infusion centers. (Which isn’t great, but that’s the U.S. healthcare system.)

Another piece of news that came out of the weekend is that the readout in PIK3CA MT was pushed back to late Q1 or Q2 2026 from EOY 2025. Again, this is bullish. One of my reasons why I thought CELC 0.00%↑ might have success in WT (see article):

…is that patients were randomized 2:1 to active arms and living longer than expected when the study was blinded. See quoted text from that article:

Data [for WT] is expected in late Q1 or Q2. Since the trial is randomized 2:1 to active arms, I would consider the delays so far in data (originally targeted for Q4 2024) to be a possibly beneficial thing. If patients are living longer than expected, and 66% are in the active arms, that’s certainly not a negative. Of course, the study is blinded. One last thing is I would not expect control arm outperformance because fulvestrant’s profile is fairly well known. The one time in a trial where the mPFS for fulvestrant was greater than 3 months was a trial that enrolled healthier patients than the inclusion criteria set forth in Celcuity’s VIKTORIA-1 trial.

Well it’s happening again, although to a lesser degree. 200 of the 350 patients in the MT trial are in a gedatolisib arm and the trial is taking longer than expected to accrue the necessary events because patients are living longer than previously expected.

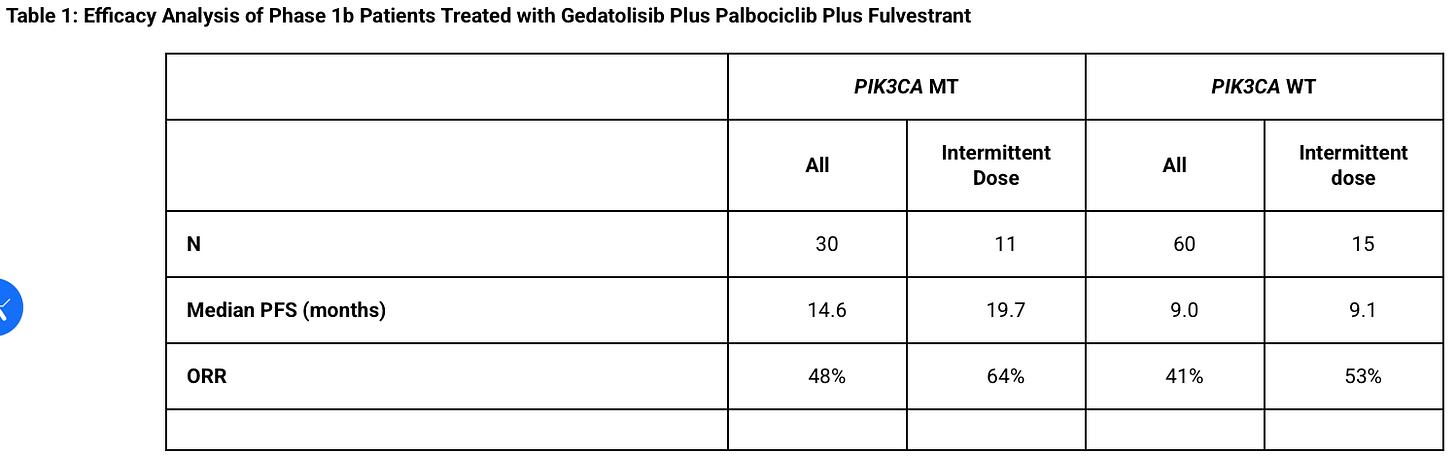

Furthermore I was going to do a longer article dissecting the Phase 1b teasing out which patients were MT and their expected survival and then Celcuity…just sent a press release out giving us the complete Phase 1b data by mutation status and based on what therapy they had (4x/monthly or 3x/monthly or “intermittent dosing” which is used in the Phase 3). I felt like this meme. Just basically had to scrap a whole article because they did it for me but they gave us very valuable de-risking information!

Here’s their final Phase 1b results:

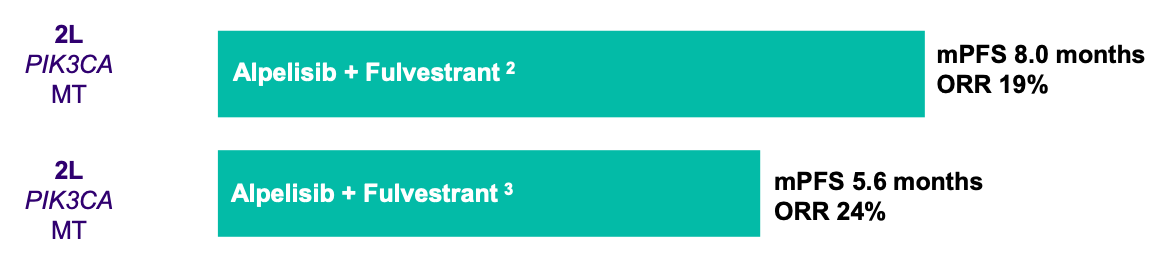

And here’s the expectations for the control arm to be somewhere between 5.6 to 8 months:

Can Celcuity bears tell me which is larger 14.6 to 19.7 months or 5.6 to 8 months?

Also I’m glad the company has an “Arm F” of just Geda + Fulv so bears can’t use the excuse that Palbociclib is contributing heavily to that 14.6 to 19.7 months of survival. This will once again provde contribution of component.

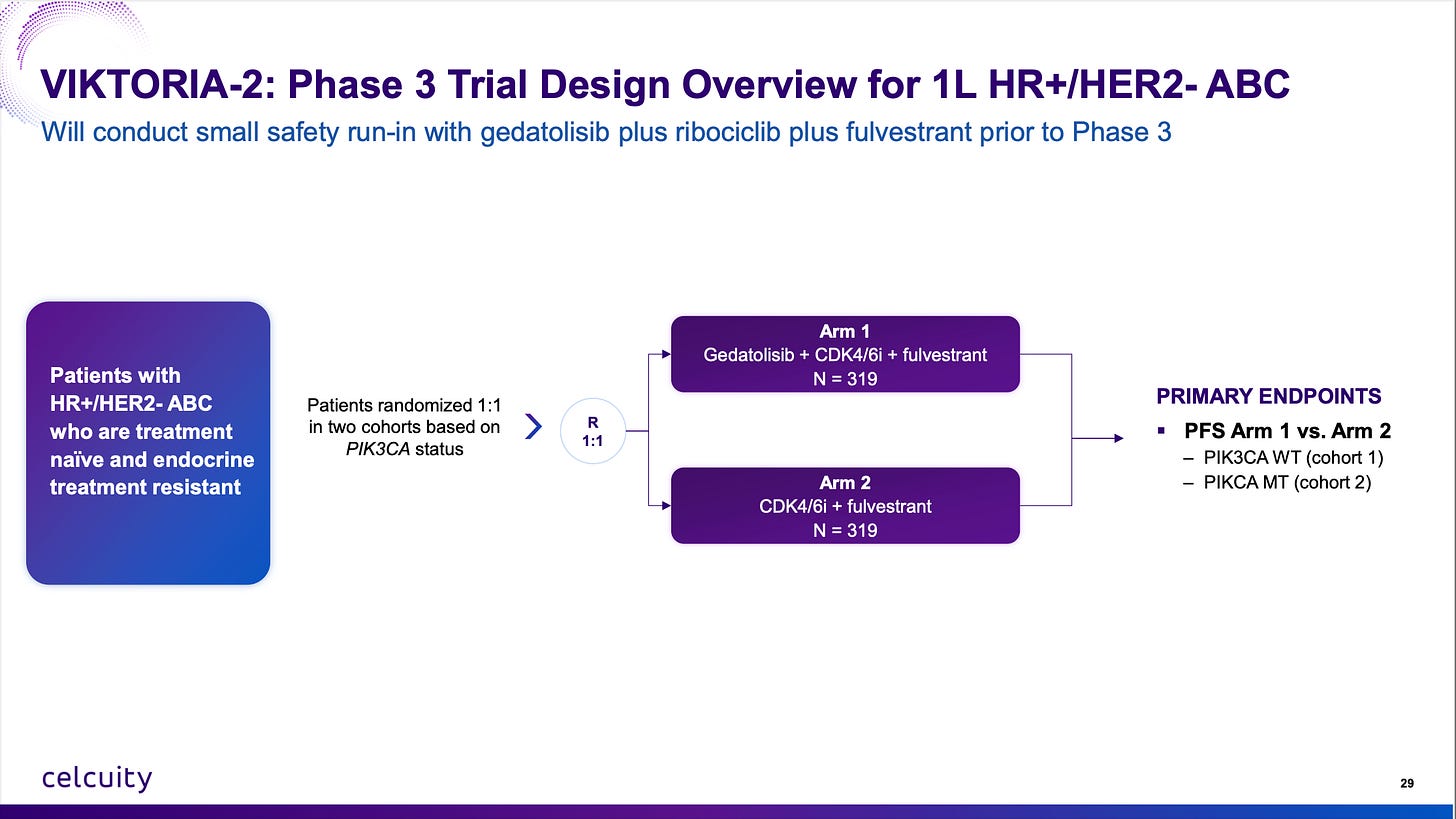

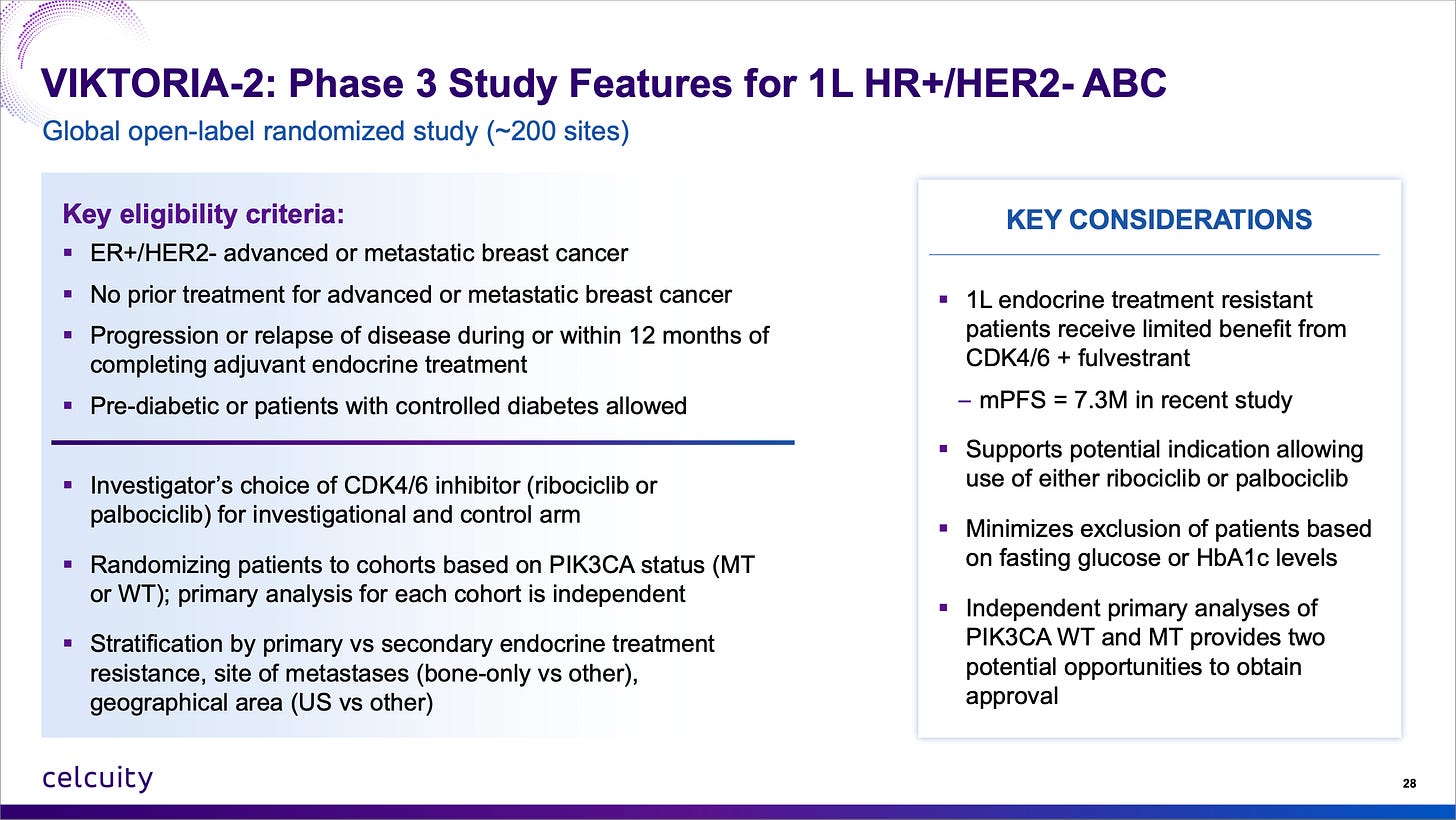

And all of this above is just talking about gedatolisib’s opportunity in 2L therapy. Everyone is (for now) ignoring the opportunity in first-line with the VIKTORIA-2 trial going on right now and top-line data likely in 2027 or 2028.

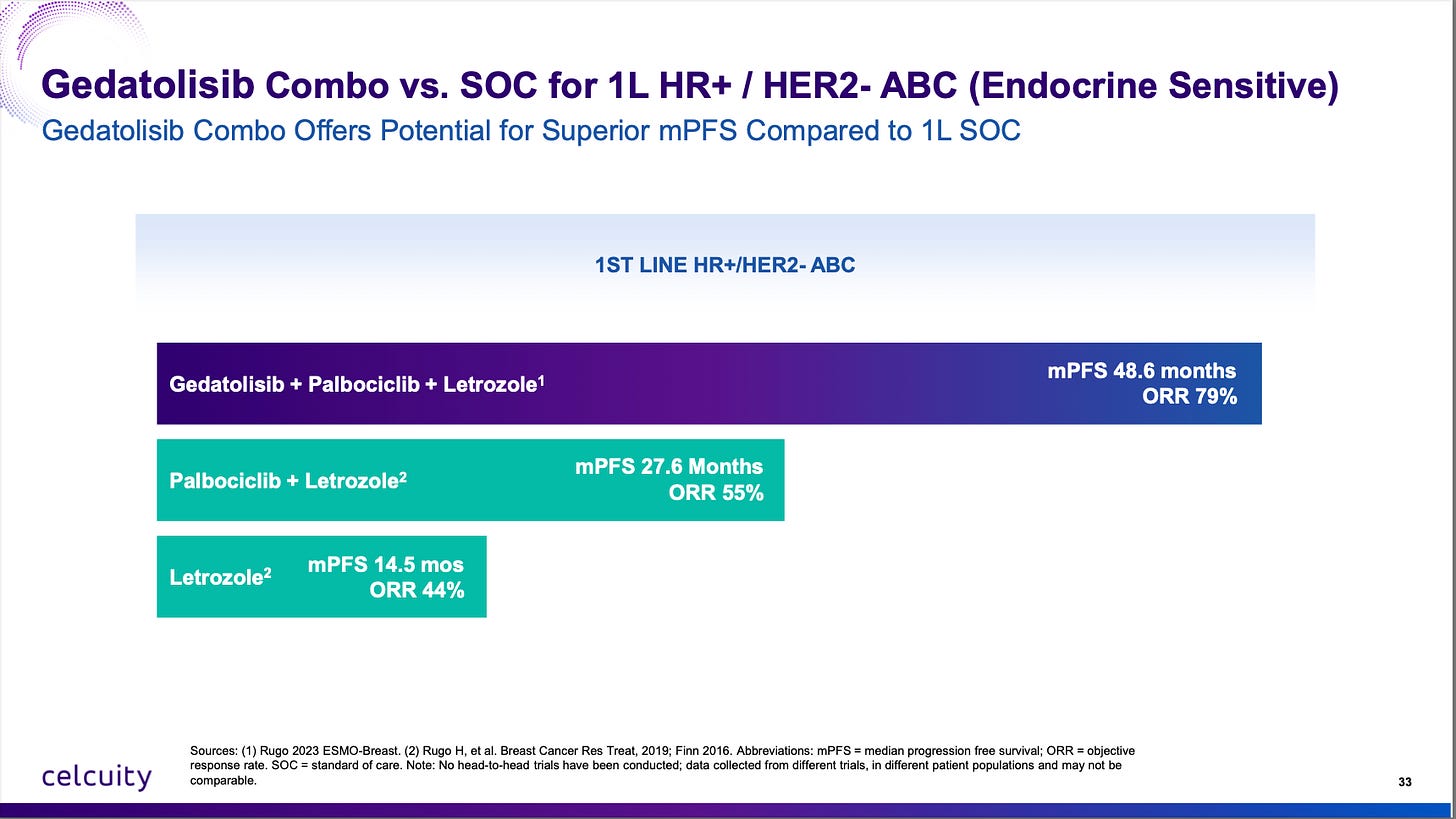

A reminder of the Phase 1b data vs standard of care in endocrine sensitive patients:

Celcuity is running a first-line trial with endocrine-resistant patients because that’s where the unmet need is and it should enroll fast, by the end of 2026 most likely with 200 global sites.

More facts here:

Do note that 7.3 months mPFS in endocrine-resistant patients. That’s a low bar to jump over and gedatolisib + CDK4/6i + fulvestrant should clear it by a large margin.

I think the totality of the 2L WT data further de-risks both the 2L MT readout and 1L endocrine treatment resistant trial. And to close I’ll just leave this right here:

Q: Delcath DCTH 0.00%↑ released positive data from their investigator-sponsored CHOPIN study but also lowered full-year guidance for the second time this year. Is the stock still a buy?

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.