Replimune Has Significant Upside Potential, When Approved. But When Will That Be?

I think they receive Accelerated Approval in July, despite new leadership at the FDA's Center for Biologics Evaluation and Research. But caution is warranted and buying post approval may be preferred.

Word Count: 3,302 words, Reading Time: 16 minutes

Today I want to talk about a company with an upcoming PDUFA action date that I believe has significant upside potential when approved. For brevity’s sake, and to get right to the thesis, I hope it’s okay if I (at first) skip over the long history of oncolytic viruses, T-VEC, a past trial failure of RP1 in Cutaneous Squamous Cell Carcinoma, and the management changes and pivots that got the company I’m going to talk about where they are today - I think it’s just helpful if we start with the recent history and data and we can fill in the gaps throughout and at the end of the article.

Replimune’s Wild Year

The last year for Replimune REPL 0.00%↑ has been full of twists and turns. On the graph below I have marked with red dots four key inflection points from the last 12 months which helps explain why the stock trades where it currently does.

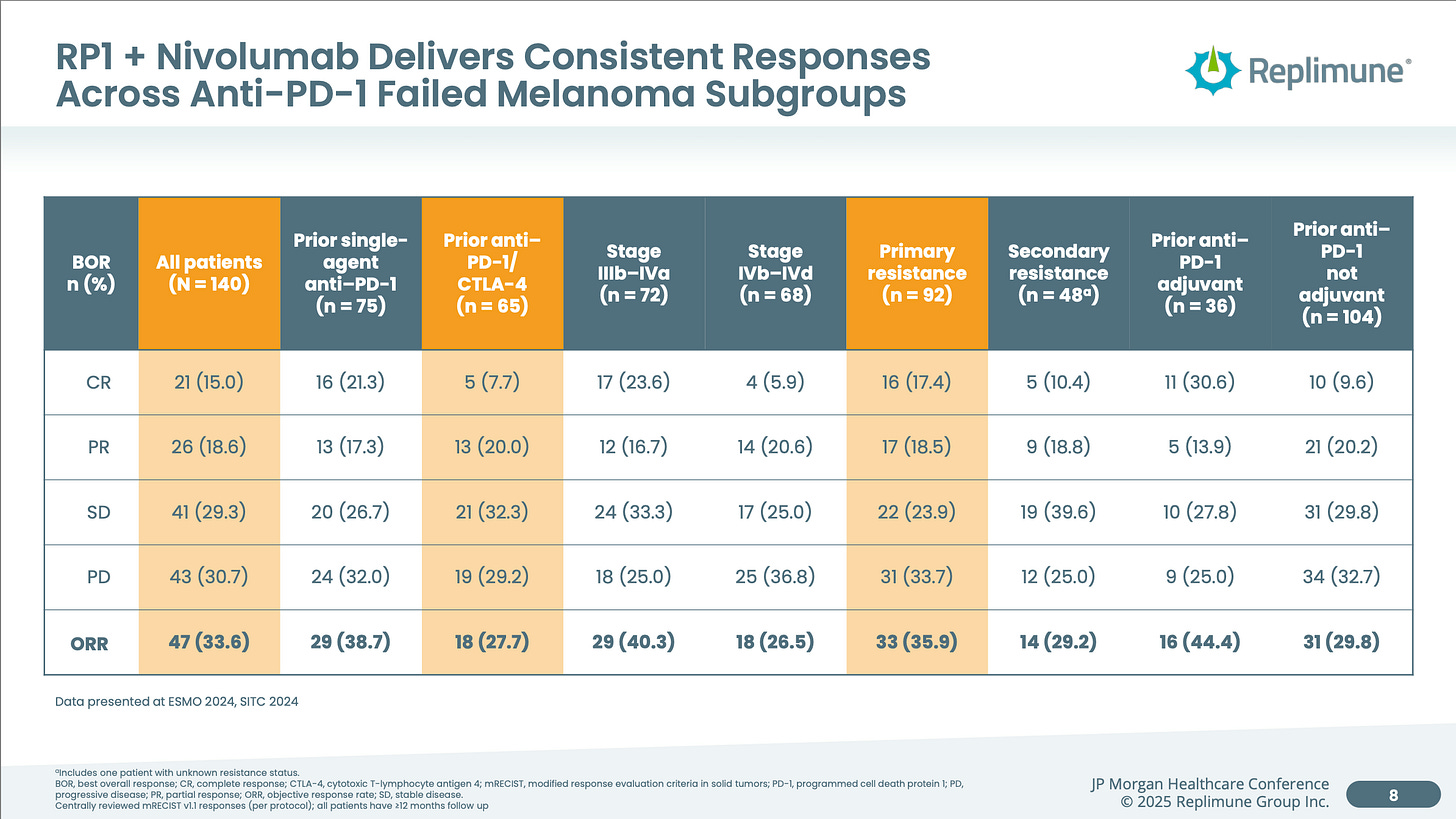

June 6, 2024: Announces “Positive Primary Topline Analysis For RP1 Plus Nivolumab in Anti-PD1 Failed Melanoma”, 33.6% ORR at 12 months, BLA plans announced

Following a Phase 3 trial failure in cutaneous squamous cell carcinoma (CSCC) in late 2023, Replimune went relatively “all in” on their RP1 drug candidate in Anti-PD1 failed melanoma. While they previously had interim data releases which tracked to this level of efficacy I think there was maybe skepticism that the full n=140 Phase 2 single arm data set in melanoma would disappoint after the unexpected failure in CSCC. Thankfully, the final data set came out very well relative to PD-1 retreatment alone as we will dive into later. The stock went from $5.56 on June 5th to the $12 level on a multi-month bullish run.

November 21, 2024: Submits BLA, receives Breakthrough Therapy Designation

The stock had settled in a bit before they announced in November that the Biologics License Application had been submitted and the company had also received Breakthrough Therapy Designation. This showed impressive execution by the company to get the filing prepared in less than six months and an excitement on the FDA’s end by giving the company Breakthrough Therapy Designation, even if the designation is somewhat freely awarded now.

January 21, 2025: BLA accepted with Priority Review, PDUFA action date of July 22

Going even further to show the FDA’s receptiveness the FDA gave the company priority review shortening the review time after BLA acceptance from 10 months down to 6 months. This showed a commitment by the agency to get new options for PD-1 failed melanoma on the market. This led to the company once again coming close to touching the 52 week high and priced in a high likelihood of approval. But then…

May 6, 2025: FDA chooses Dr. Vinay Prasad to lead biologics, vaccines division

For every three pieces of good news, there must be one piece of bad news because this is biotech, right…? On May 6, Dr. Vinay Prasad was selected to head the FDA's Center for Biologics Evaluation and Research and that selection alone caused Replimune’s stock to decline by 25%. I’ll get into the specifics for that below but comments he had made in the past were not perceived as friendly to the company’s strategy and possibly signaled a shift in the FDA’s openness towards giving Replimune accelerated approval. This is important because their Phase 3 trial is currently enrolling and won’t produce pivotal Overall Survival data until likely 2028 due to the time needed to accrue the necessary events.

The way I would like to tackle this now is to first assess RP1’s product profile and competitive advantages if approved, then cover the likelihood of approval on July 22, and finally list out Replimune’s options if the FDA decides to play hardball and delay or deny Accelerated Approval.

RP1’s Market Potential In Anti-PD1 Failed Melanoma

The most recent approval and most efficacious option in Anti-PD1 failed melanoma is Iovance’s cell therapy AMTAGVI. I thought it would be best to go point by point to show why if RP1 is approved then I think AMTAGVI is in serious trouble as Replimune could win a vast majority of the market very quickly. Also, since Iovance’s business model relies on scale, I think Iovance would be at solvency risk as a going concern unless their upcoming lung cancer data is excellent. But I don’t short stocks so I’m going to keep this mostly focused on RP1 and Replimune.

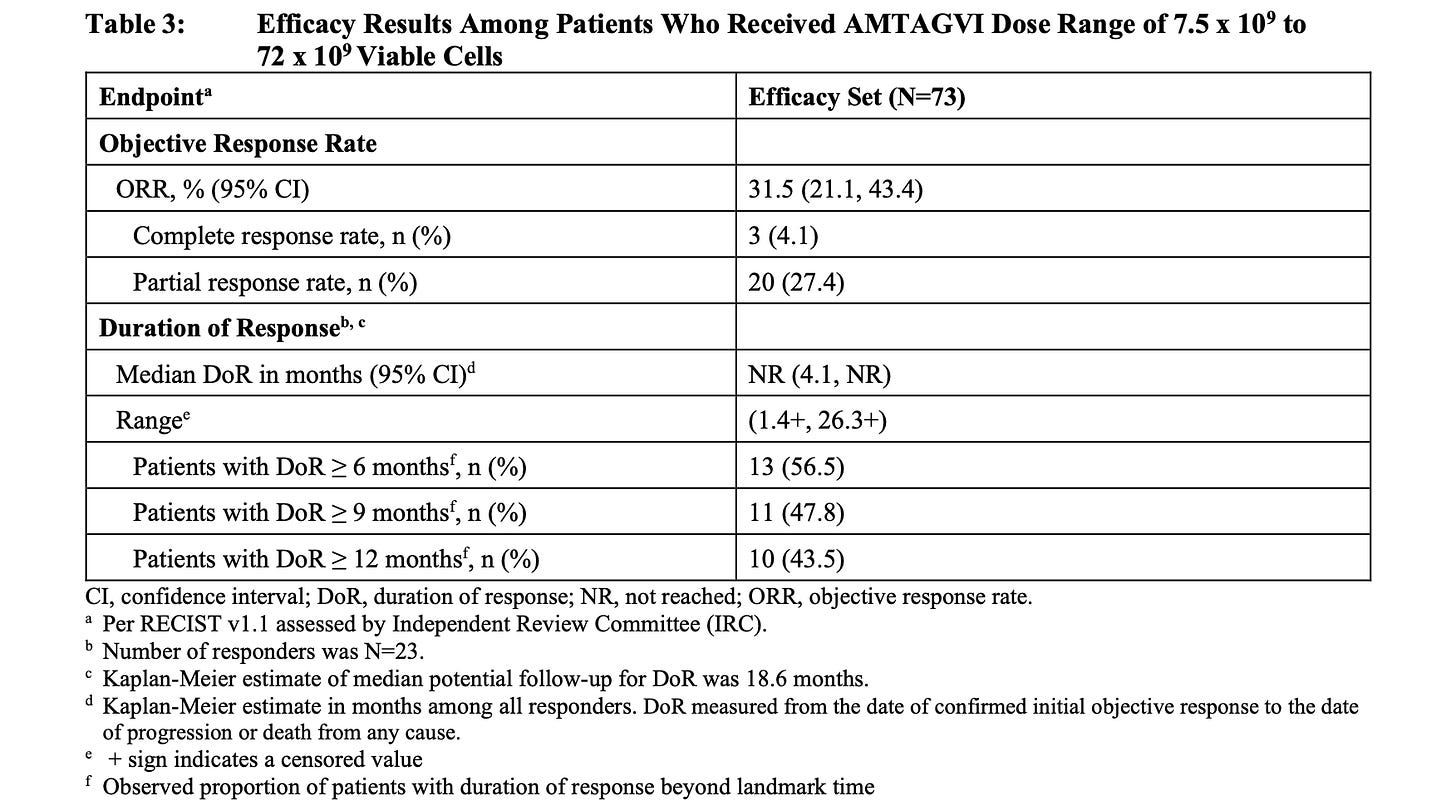

Let’s start with efficacy. AMTAGVI’s label shows an ORR of 31.5% in a data set of 73 patients.

Meanwhile, RP1 + Nivolumab achieved an ORR of 33.6% in a much large 140 patient data set. Even with numerical superiority and a larger sample size, I’m fine calling the response rates relatively equal or within the margin of error.

The four areas I think Replimune will win in are Durability, Tolerability, Manufacturing, Speed.

Let’s look first at durability. As shown in the AMTAGVI efficacy set above the duration of response out to 12 months was 43.5%. Compare that to RP1 + Nivo below which showed roughly 65% of responders showing duration of response out to 12 months not to mention a median duration of response of 21.6 months. Moreover still the company was able to demonstrate extremely promising overall survival data compared to Nivolumab alone which would be expected to be around a median of 12 months overall survival. A single arm study, sure, but extremely strong data.

AMTAGVI is also a very taxing therapy for a patient. Look at the patient package insert below. I didn’t even have space to include the section on Grade 3 and Grade 4 laboratory abnormalities but you can find the package insert here.

Also manufacturing for this product does not have a 100% success rate compared to RP1 which is an “off-the-shelf” therapy injected directly into lesions. Furthermore, the time from when a patient is a candidate for AMTAGVI to receiving therapy takes roughly 10 to 12 weeks right now by Iovance’s own admission. (See the slide below.) Compare that to RP1 which can be started next day as long as the patient has reimbursement.

With relatively equal efficacy (for argument’s sake) but superior durability, tolerability, manufacturing, and turnaround time, I am hard pressed to see why any provider would choose AMTAGVI when RP1 becomes available. RP1 does need to be injected directly into the lesions and most patients (~80%) have deep lesions but that is something that Inventional Oncology can handle and is still in my eyes preferable to a cell therapy from a patient experience perspective.

From Replimune’s recent (and first) earnings call:

And so we know that today, when patients progress on a PD-1, they start on PD-1 therapy in the front line setting, half of them are going to progress within 6 months. And so for these patients, they don't have oftentimes 6, 8 or 10 weeks for the next treatment option to be employed. When we talk to physicians in the community, melanoma experts around the country, when they start a patient on a treatment and it's working well and it's tolerated well, they will rarely remove that patient from treatment.

And so our position is that RP1 will be positioned as a first-line option for patients who progress on PD-1 therapy based upon our deep and durable response rates, our safety profile and our next-day distribution and off-the-shelf ease of convenience, which again, really helps to support broad and rapid adoption once approved.

All of this doesn’t even cover that AMTAGVI as a cell therapy has a high Cost Of Goods Sold and a wholesale acquisition cost of $515,000. There is plenty of headroom to compete with AMTAGVI in Anti-PD1 failed melanoma patients across multiple metrics. Iovance is still losing a lot of money per quarter by the way. They are a weakened state from a balance sheet perspective and their stock is trading close to an all-time low. Dilution is not really an option for them to raise money nor is debt.

RP1’s Odds Of Approval On July 22

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.