Short sellers are confident Cardiff Oncology will underwhelm - but are they right?

A forthcoming 1H data update has the power to significantly de-risk the stock yet short interest is piling up to greater than 20% of the shares outstanding.

Word Count: 2,021 words, Reading Time: 10 minutes

Another post on the shorter side this week as I think this is another dead simple thesis in the oncology space with hard catalysts this year, just like last week’s post with Ideaya. Normally I don’t prefer to play in the oncology space in general because of high competitive risk but like last week this is a beautiful setup with little to no competitive threat if it works and another huge addressable market. IDYA has had incredible strength since the “Tariff Lows” so I hope some subscribers are sitting on a positive position if they chose to jump in there. And obviously I hope this one works as well. Time will tell! But this is one of my Top 10 favorite ideas of the moment.

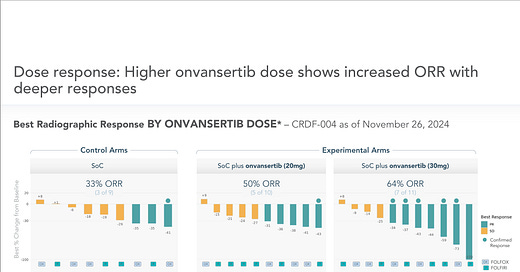

Cardiff Oncology CRDF 0.00%↑ will report a data update in the next two months which should yield a fairly comprehensive verdict on their main asset, onvansertib, a PLK1-selective inhibitor. The company will report a roughly 60 patient data set in 1L RAS-mutated metastatic colorectal cancer - ~20 evaluable patients in the chemo SoC arm, ~20 evaluable patients in the Chemo SoC + 20mg onvansertib arm, and ~20 evaluable patients in the Chemo SoC + 30mg onvansertib arm. That’s a decent sample size with 40+ patients in active arms as well as well-established historical controls in multiple peer-reviewed trials to compare to the placebo arm response.

The first data update from this trial was actually pretty promising but, aside from allowing the company to do an offering into relative strength, the stock is not getting much credit. In fact, sitting at a $190 million market capitalization with $90 million in cash on hand, minimal debt, and short interest of greater than > 20% of the shares outstanding it seems the overwhelming consensus is that the upcoming data will disappoint. I’m not so sure about that.

To first understand why onvansertib has a chance to surprise let’s travel way back to the rationale for this upcoming 1L Ras-mutated mCRC trial in the first place.

Underwhelming 2L Results

When Cardiff announced development plans in 2L mCRC in September of 2022, the results were greeted with an overwhelming groan as the stock halved in the fact of what looked to be a long and relatively fruitless roadmap. There was maybe some slight signal looking at the responses but the company was rudderless and not able to effectively make their case to shareholders. That changed somewhat in 2023 when they did further analysis on their data to find that the patients who had not been previously exposed to bevacizumab did far better than expected historical controls compared to the bev exposed patients which mostly matched historical controls. The delta between the two cohorts you would expect to be ~2 months when in their data it was 7 months. Post-hoc, sure, but an interesting finding.

This company did further work to chase down this hypothesis. They ran new pre-clinical studies with combination therapy vs single-agent therapy and also did a gross dissection of the pre-clinical tumors for evaluation. The tumors were not only smaller but less vascularized.

The hypothesis generated was that onvansertib’s mechanism was synergistic with bevacizumab in inhibiting a tumor’s ability to adapt to hypoxia.

This work led to a paper, published (direct link to PDF) here, and a patent, announced here, which would provide some level of IP protection out to 2043.

Back To The Drawing Board

All of this work led to a June 2023 Type C meeting with the FDA where the company received clearance to go ahead with a Phase 2 trial in 1L (bev naive) KRAS-mutant metastatic colorectal cancer. The trial, CRDF-004, would be similarly sized and designed as the 2L trial and would receive support from Pfizer in the form of their “Ignite” program which provides developmental support and expertise.

The trial has two active dose strengths and is stratified to include both investigator’s choice chemotherapy regimens. The very first data from this trial was released on December 10, 2024 and accompanied by a registered direct offering. (Because - practically everything is now. ☺️)

Early 1L Data Reinforces Pre-Clinical Work

I found the December 2024 data to actually be very impressive. Yes, the patient number was small (30 total evaluable patients) and the control arm might have slightly underperformed in raw ORR numbers but this is relatively early data and all arms could see further responses. But, IF this level of delta between active and control holds, this is unquestionably a very valuable drug:

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.