TG Therapeutics Should Increase Their Share Buyback Authorization Immediately

The company is thriving, there is no business development opportunity better than the anti-CD20 space, and the company has sufficient liquidity to be aggressive.

Word count: 2,076 words, Reading Time: 10 minutes

Last week, at the end of my article, I wrote about TG Therapeutics (behind the paywall, pay $10/month!) but I don’t feel I gave them the credit they earned.

They deserve a full article this week.

This is a company that is operating at an extremely high level and I wanted to take this week to single out why they are different than most other commercial-stage companies and why I included them last week despite having a noticeably higher Price/Sales multiple than the other names I wrote about. (7.5x NTM vs. <4 for the other companies.)

Today I intend to make the argument why they should immediately fully utilize their $100 million share buyback authorization and then, when finished, announce a new $200 million share buyback authorization on their next earnings call.

A Brief Intro

TG Therapeutics is a company that did not interest me in the years before approval. That was because they had an oncology pipeline that at the time was negative Net Present Value, there was a lot of negativity from other investors around the CEO’s decision making, and the valuation seemed a bit rich at the time for a Relapsing-Remitting Multiple Sclerosis program with lots of outstanding risk factors. I changed my tune about a year into approval because:

The oncology programs were dropped and this is now essentially a Multiple Sclerosis pure play.

The company is executing their launch with tremendous efficiency and their CEO and management team deserve credit.

It is clear that anti-CD20 drugs are here to stay as the standard of care in RRMS, will be growing into the 2030s, and TG’s drug BRIUMVI has best-in-class efficacy among all entrants and best-in-class label among IV administered therapies. Their launch has been fundamentally de-risked.

I’m writing it about it now because I believe this is the best return/risk ratio since I have been following the company.

Let’s look at the anti-CD20 market as it stands today.

Anti-CD20 Market

The anti-CD20 space is relatively easy to understand due to its relative lack of competition, excellent clinical results making it essentially a backbone therapy in RRMS, and lots of market data available around new patient starts and total sales which makes it easy to understand the switching dynamics at play. Additionally, no near-term programs close to approval means any currently growing drug in this space is relatively well insulated from erosion and can be valued at a higher multiple.

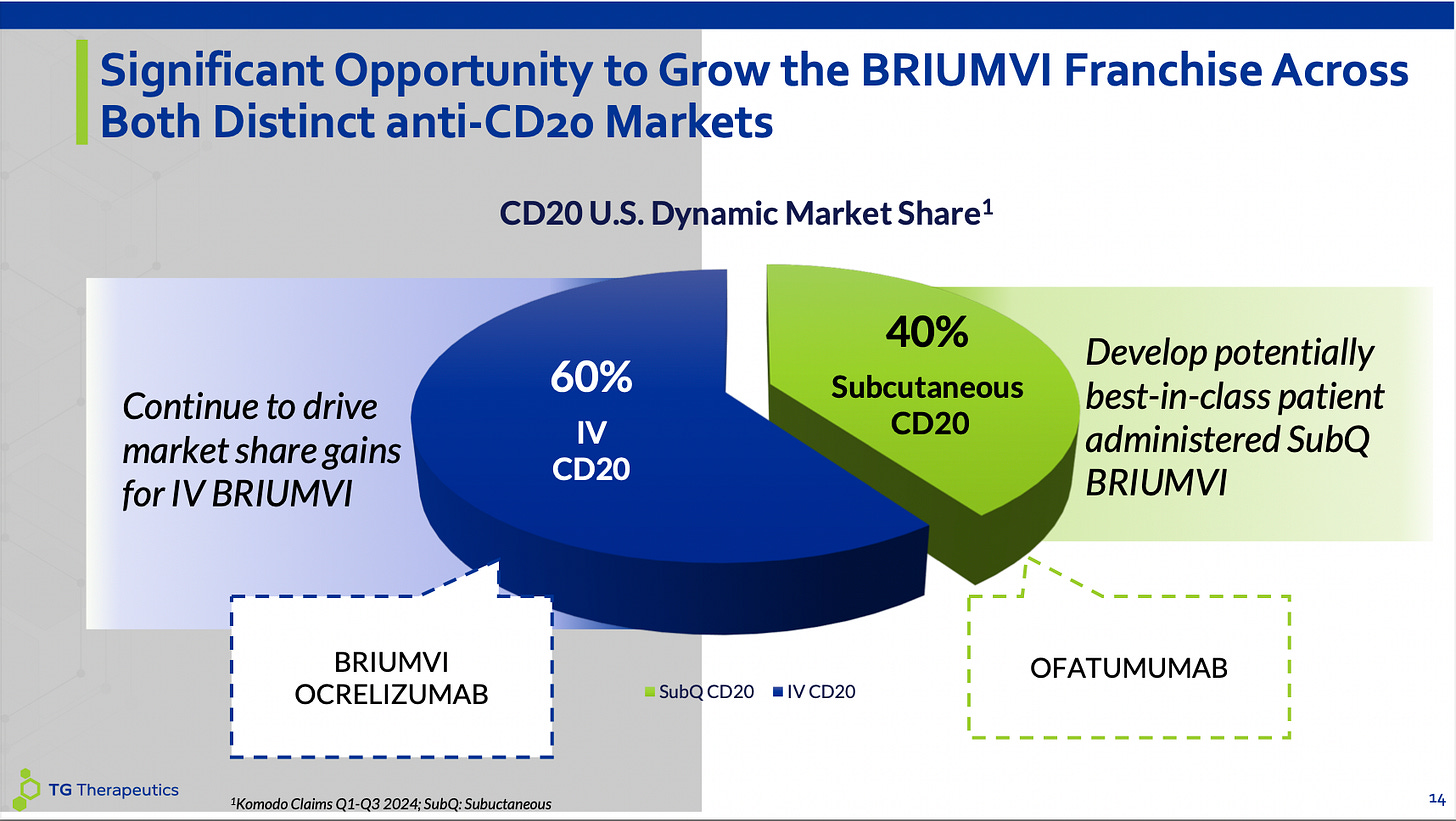

BRIUMVI currently plays in the IV space of this market and is taking share from Ocrelizumab (OCREVUS) which was the first innovator in the space but has peaked and is now seeing erosion due to the two newer approvals in the market. Currently, there is only one subcutaneous option and that side of the market is growing due to ofatumumab (KESIMPTA) being a fairly good drug and subcutaneous injections being a convenient form factor for a long-term medicine. BRIUMVI will eventually play on both sides of this graph as they are starting a pivotal program this year for a subcutaneous version of their medicine this year. Importantly, BRIUMVI could eventually be dosed subcutaneously every 2 months or even every 3 months which would be superior to KESIMPTA’s monthly dosing. Also I expect a good portion of the market to stay with IV infusions. Physicians like IV infusions because they can verify compliance, can make sure the patient does not have any adverse events, and also some of physicians have a financial interest in infusion centers giving them incentive to remain “set in their ways” regarding keeping patients on IV infusions.

Either way, the goal for BRIUMVI is to become a best-in-class medicine in both IV anti-CD20 and SQ anti-CD20 spaces so it won’t matter what route of administration market share split the market ends up adopting.

BRIUMVI has a great product profile. I already mentioned if approved in subcutaneous form it will likely have the best administration profile in the SQ space but in IV administration is very simple once the patient receives the loading doses and their infusion time is one hour versus 2 to 4 hours for OCREVUS. And they are running further post-marketing studies to further shorten the infusion time and simply the loading dose regimen to one infusion.

Efficacy-wise, BRIUMVI boasts the best data when it comes to Annual Replase Rate (ARR), the gold standard endpoint for comparison in RRMS.

BRIUMVI’s label does not include a warning for breast cancer where OCREVUS’ label does. I should note however that BRIUMVI’s label has a warning for fetal risk where OCREVUS’ label doesn’t. However considering most women beginning treatment for RRMS probably start therapy close to the age of 40 I think a warning for breast cancer risk is far worse relevant to a greater chunk of the female population than a fetal risk warning. BRIUMVI and KESIMPTA have essentially the same label across the board, with both containing a warning for fetal risk.

All of this to say: BRIUMVI has been in class efficacy among the three anti-CD20 medications. In the IV space, it has a better label than OCREVUS in my eyes and is a one hour infusion versus 2 to 4 hour infusion. In the SQ space, BRIUMVI will have likely have label parity with KESIMPTA but will be available every 2 months or every 3 months versus monthly for KESIMPTA.

All of this to say, I think BRIUMVI is a best-in-class medicine on all the metrics that matter. It is also the lowest price medicine of the three although with the rebate games pharmacy benefit managers play it’s unclear if that really matters at all.

Growing Revenues And Controlling Costs

Here is a sheet I use to track TG’s launch. This starts with Q2 2023 which was the first full quarter of launch. The blue line is revenue which is seeing very nice and consistent growth. The red line is operating expenses and I need to clarify the spike for Q1 2025.

From the recent earnings call:

This increase [in R&D spend] during the quarter was primarily driven by about $20 million in manufacturing investments for subcutaneous BRIUMVI.

I think it’s also to assume SG&A for the quarter was elevated due to annual bonuses being paid out and the company blowing projections out in 2024.

All of this to say: I do not think COGS + R&D + SG&A will come remotely close to exceed $100 million per quarter for the rest of the year. In fact, they should fall far below as a total based on the company’s own guide for what to expect the rest of the year.

Keep reading with a 7-day free trial

Subscribe to Matt Gamber’s Biotech Newsletter to keep reading this post and get 7 days of free access to the full post archives.